What Is My New Jersey Employer Registration Number

What Is My New Jersey Employer Registration Number, Indeed recently has been hunted by consumers around us, perhaps one of you personally. People now are accustomed to using the internet in gadgets to view video and image information for inspiration, and according to the name of this article I will discuss about

If the posting of this site is beneficial to our suport by spreading article posts of this site to social media marketing accounts which you have such as for example Facebook, Instagram and others or can also bookmark this blog page.

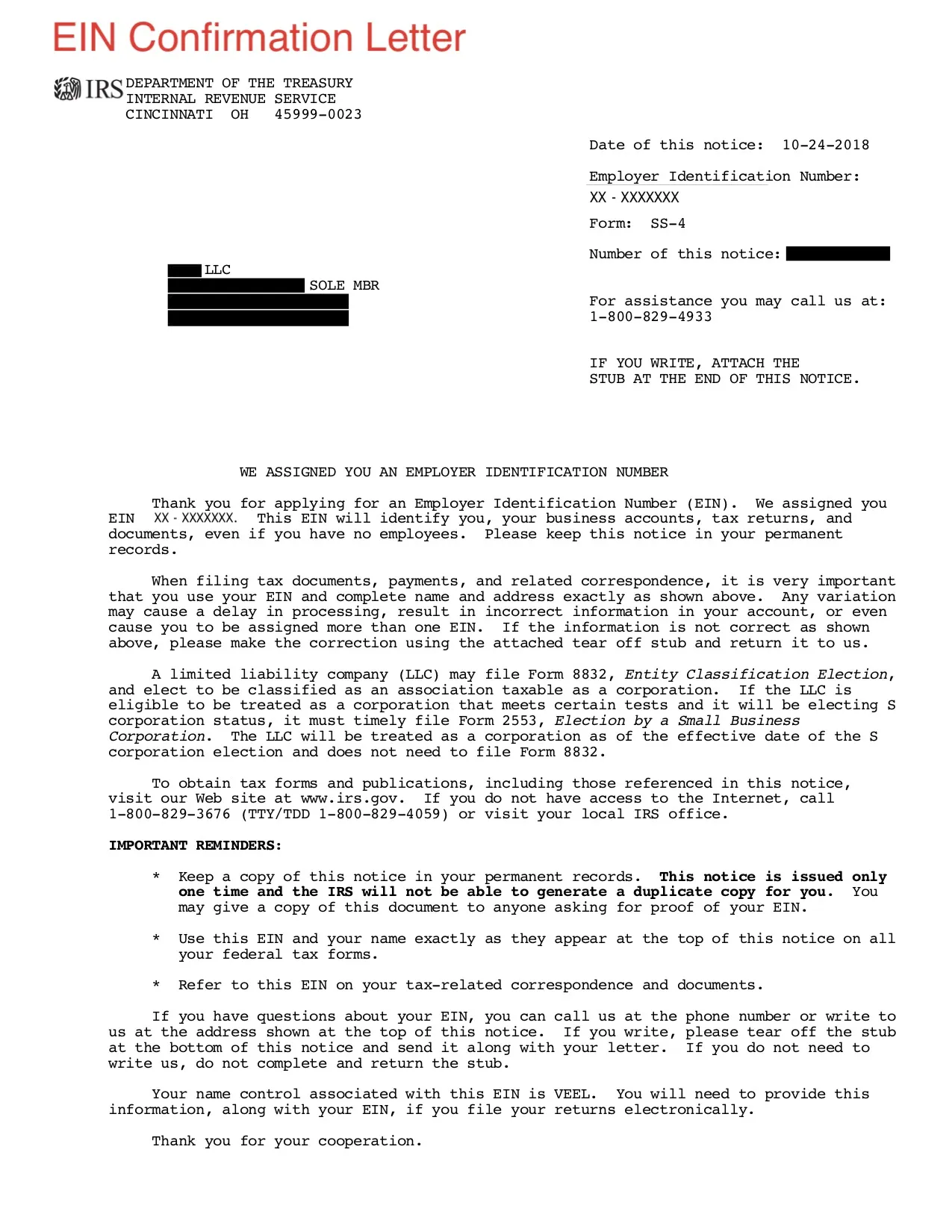

Known as an employer identification number ein the format of this number is two digits with a dash followed by seven more digits.

Basketball jersey for sale in nigeria. You want to start a new business in the state of nj llc pa dp non profit etc you need to authorize a legal entity in nj for your business in another state. Once you finish each section it will be marked with a check mark. It helps the irs identify your business for tax and filing purposes.

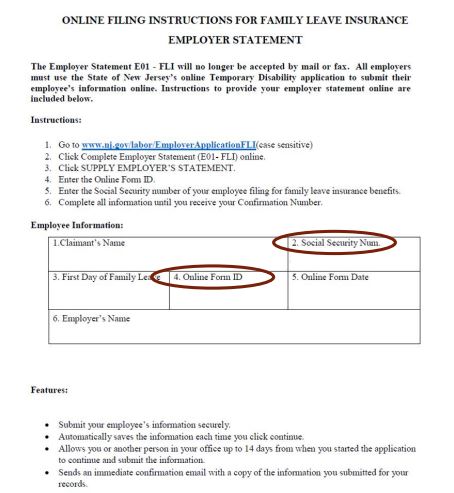

New jersey division of revenue dor income tax withholding and unemployment tax. Once your established business employs one or more individuals and pays wages of 1000 or more in a calendar year you are considered an employer. Your new jersey employer registration number matches your nine digit federal employer identification number fein.

Register a new company. Make sure your business is registered with the new jersey department of labor. New jersey tax agency.

Your ein will be listed at the top of form 941. If youre unsure of your rate call the agency at 609 633 6400. Having an ein for your new jersey llc allows you to complete your business registration application discussed in the prior lesson open a separate bank account under the llcs name apply for.

The twelve digit employer identification number issued by new jersey consisting of the federal employer identification. Filing form nj reg ensures that your business is registered under the correct tax identification number and that you will receive the proper returns and notices. Allows your business to pay required unemployment and disability insurance in new jersey.

New jersey has defined 4 digit numbers to identify the product group or service of your business. If you are unsure of your ein you can locate it on any previously filed tax forms. When you start entering a keyword or 4 digit code in the field it will start displaying options that match.

An ein is to your new jersey llc what a social security number is to a person. Employers are required for tax purposes to have a registration or identification number that is assigned by the internal revenue service. The nine digits are your federal employer identification number fein and the prefix and the suffix are zeros.

Documentation from new jersey department of labor will typically show your account number in the following format. Normally you will use your federal employer identification number fein as the new jersey tax identification number. At that point you must provide quarterly wage reporting via form wr 30 and pay applicable unemployment ui workforce development wf.

New jersey employer registration number. Please use the navigation to the left to complete your registration filing. The complete list is available here.

All businesses must first register with the division of revenue enterprise services form nj reg. In most cases your nj employer registration number will be the same as your federal ein but they also have three extra numbers at the end.