State Of New Jersey Withholding Tax

State Of New Jersey Withholding Tax, Indeed recently has been hunted by consumers around us, perhaps one of you personally. People now are accustomed to using the internet in gadgets to view video and image information for inspiration, and according to the name of this article I will discuss about

If the posting of this site is beneficial to our suport by spreading article posts of this site to social media marketing accounts which you have such as for example Facebook, Instagram and others or can also bookmark this blog page.

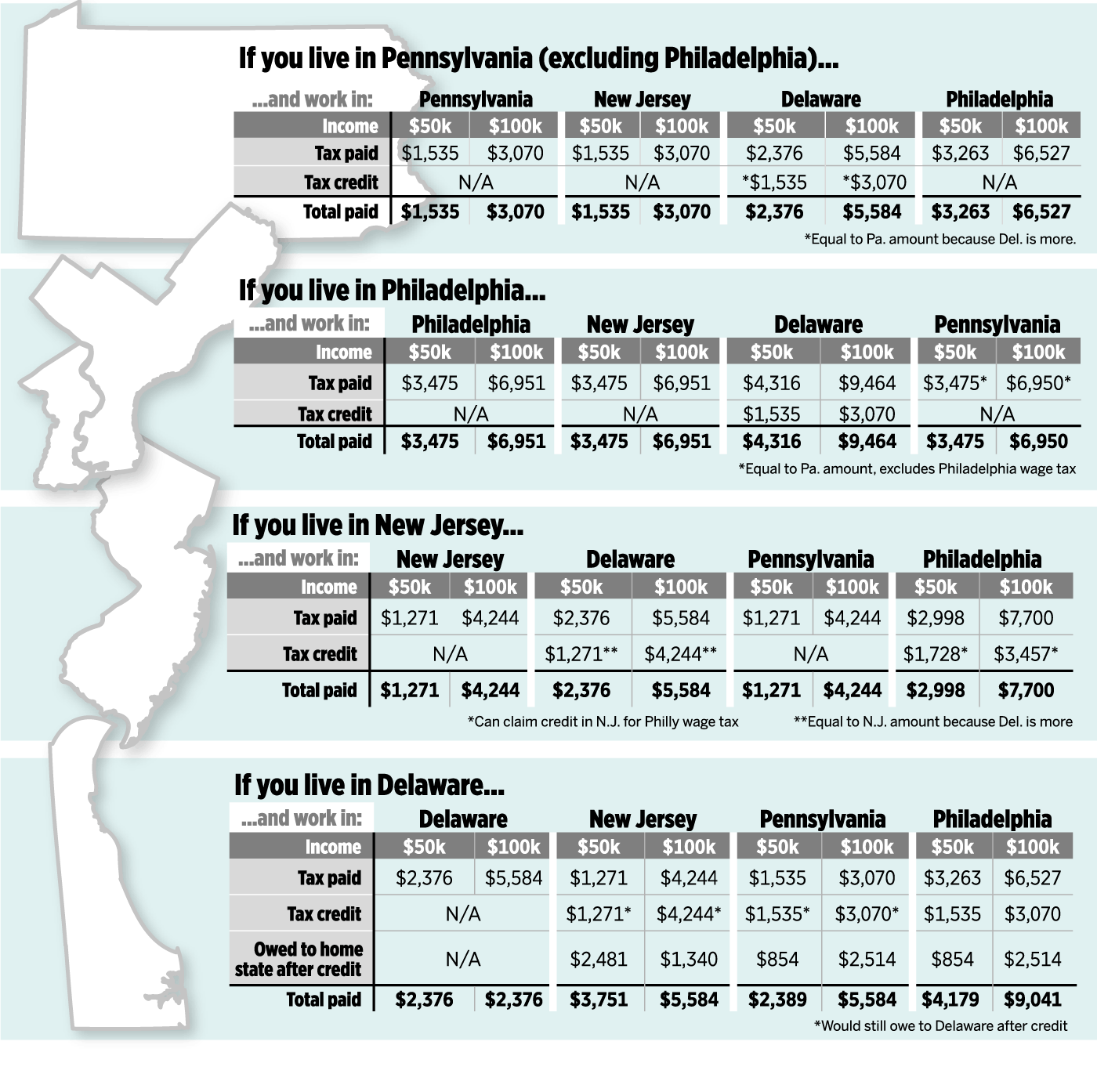

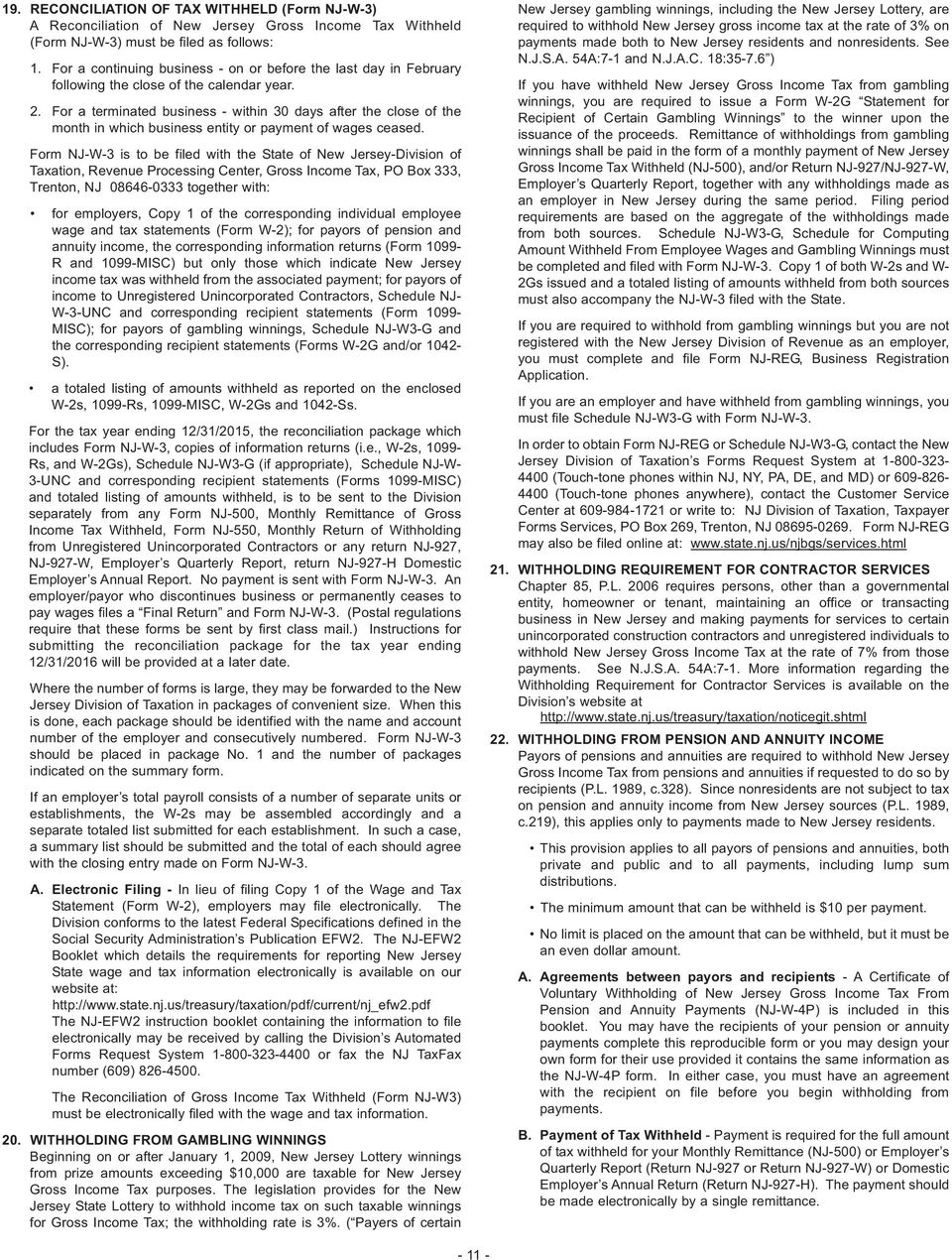

New jersey employers must furnish form nj w4 to their employees and withhold new jersey income tax at the rate selected.

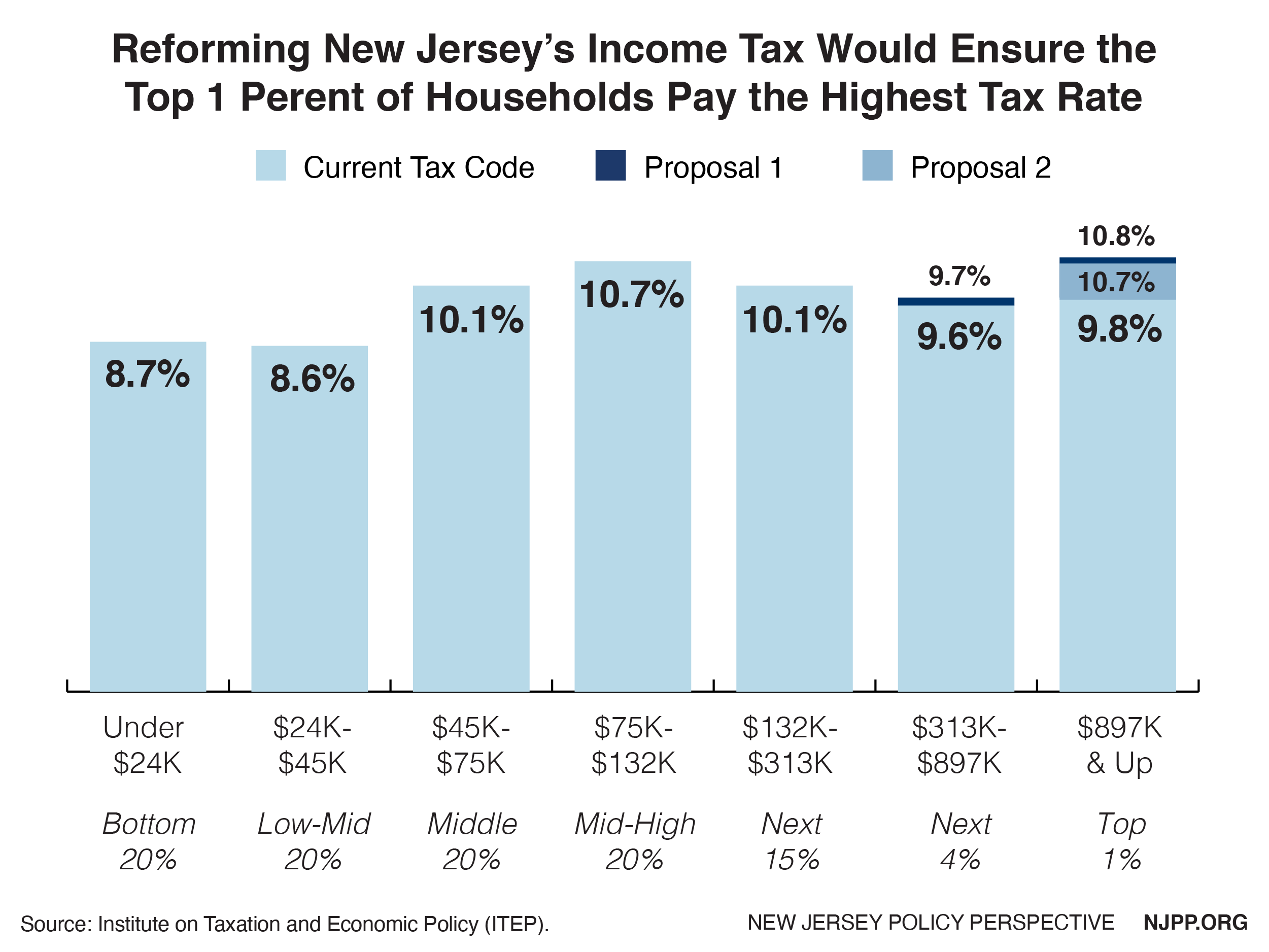

Jersey jordan negro. Subject to the withholding tax of that state. As a new jersey employer you are required to withhold new jersey income tax from wages paid to all state residents unless you are withholding another jurisdictions income tax at a rate equal to or greater than new jerseys rate. Product download purchase support deals online cart.

If you have questions about eligibility filing status withholding rates etc. No state or federal taxes will be taken out of your stimulus check and any stimulus money received does not affect your 2020 tax return. And the withholdings required by that state equal or exceed the withholdings required for new jersey.

When an employee has more than one job or if spousescivil union partners are both wage earners the combined incomes may be taxed at a higher rate. New jersey cannot provide any information about the amount eligibility or when you may receive a payment. W2 1099 1095 software.

You must complete and submit a form each year certifying you have no new jersey gross income tax liability and claim exemption from withholding. Please visit the irs website for more information. If the employee works only part of the time out of state or the other states withholding tax rate is lower than new.

You must also withhold new jersey income tax for nonresident employees physically working in this state. Employed totally outside new jersey.