State Of New Jersey Where Is My Refund

State Of New Jersey Where Is My Refund, Indeed recently has been hunted by consumers around us, perhaps one of you personally. People now are accustomed to using the internet in gadgets to view video and image information for inspiration, and according to the name of this article I will discuss about

If the posting of this site is beneficial to our suport by spreading article posts of this site to social media marketing accounts which you have such as for example Facebook, Instagram and others or can also bookmark this blog page.

2019 2020 Tax Season Average Irs And State Tax Refund And Processing Times Aving To Invest When Is The New Jersey Lottery Drawing

You may check the status of your refund on line at new jersey department of revenue.

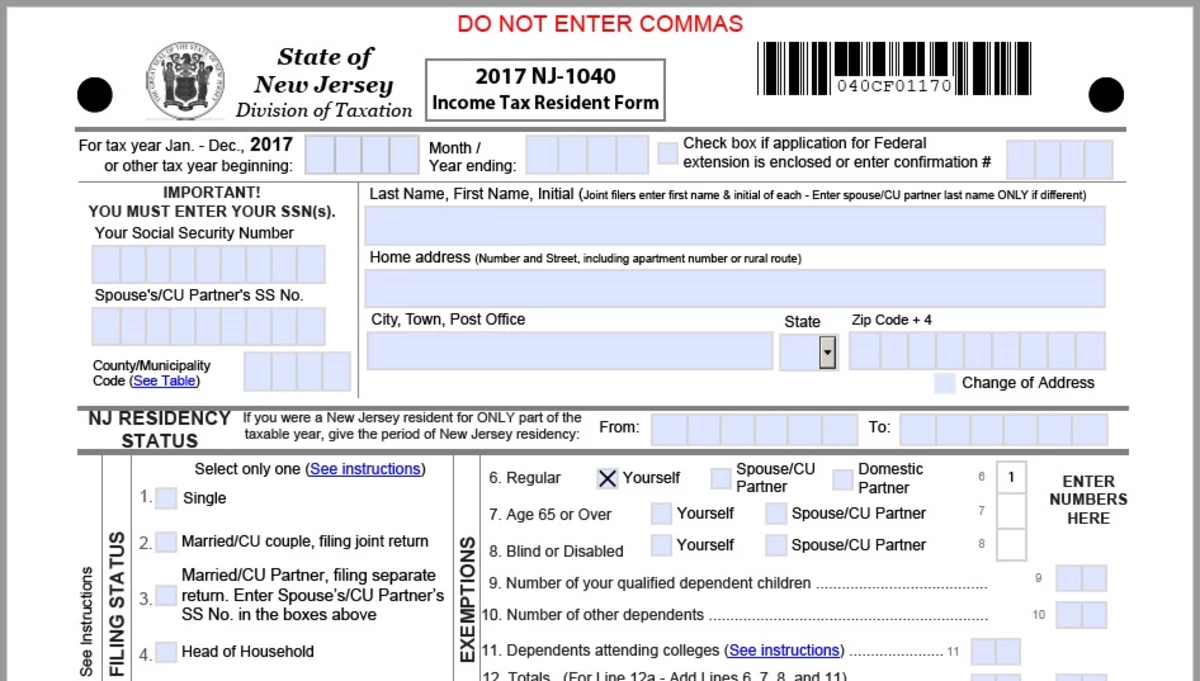

When is the new jersey lottery drawing. Wheres my new jersey tax refund. An automated script will lead you through the steps necessary to determine the amount of your tax refund. Nj residents need to file a form nj 1040x.

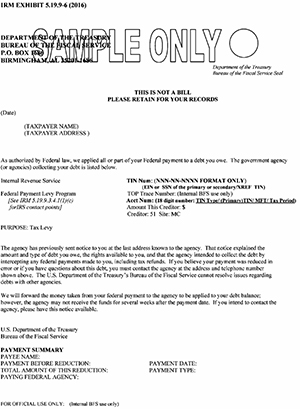

Wait 12 weeks to check your refund if you filed a paper return. Beginning in january new jersey processes individual income tax returns daily. If the department needs to verify information reported on your return or request additional information the process will take.

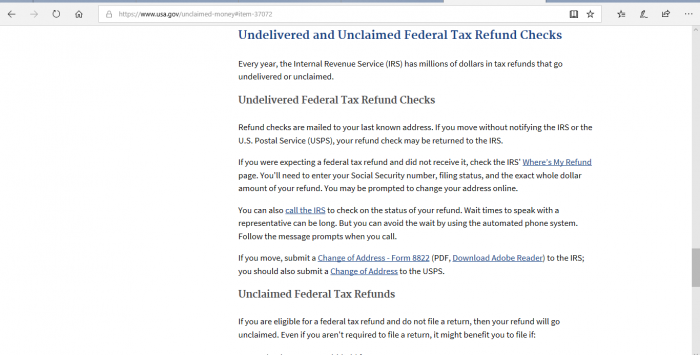

Just fill in your social security number or individual taxpayer identification number expected refund amount and the filing tax year and you can get instant information about your refund. Social security number listed first on your tax return. Before checking on your refund wait four weeks from the day you filed an electronic online return.

Amended new jersey state returns must be printed out and mailed to the new jersey division of taxation. Respond to a letter your refund was adjusted tax department response to spread of coronavirus the new york state tax department is responding to the spread of novel coronavirus covid 19 as it affects taxpayers. To do so you must know the.

Check your efiling status refund for any state. Taxpayers who have access to a touch tone phone may dial 1 800 323 4400 within new jersey new york pennsylvania delaware and maryland or 609 826 4400 anywhere to learn the status of their tax refund. Processing returns and issuing correct refunds is the goal of the new jersey department.

Since refund fraud resulting from identify theft has increased we are using additional tools to protect new jersey taxpayers. Non residents should use a form nj 1040nr and write the word amended in the upper right hand corner. These anti fraud protections need to be revised every year because perpetrators are becoming more adept at refund fraud.

You can start checking on the status of your return within 24 hours after they have received your e filed return or 4 weeks after you mail a paper return. New jersey works hard to prevent identity theft and fraudulent use of taxpayer information. New jersey department of revenue issues most refunds within 21 business days.

You should only use the online refund status service if you filed your return at least 4 weeks ago electronically or 12 weeks ago paper. Track the status of your refund by using the new jersey department of revenues wheres my new jersey state refund tool. Exact amount of your refund.

You may use our online service to check the status of your new jersey income tax refund. These anti fraud protections cause a small delay in receiving your tax refund. How new jersey processes income tax refunds.

These enhanced efforts could result in early filers experiencing a slight delay in receiving their refunds.