State Of New Jersey Tobacco License

State Of New Jersey Tobacco License, Indeed recently has been hunted by consumers around us, perhaps one of you personally. People now are accustomed to using the internet in gadgets to view video and image information for inspiration, and according to the name of this article I will discuss about

If the posting of this site is beneficial to our suport by spreading article posts of this site to social media marketing accounts which you have such as for example Facebook, Instagram and others or can also bookmark this blog page.

Here are some guidelines on how to obtain tobacco wholesaler and retail licenses in the state of new jersey.

State of new jersey executive orders. It is mandatory to obtain relevant permits and licenses when manufacturing importing selling tobacco products. Resident distributors cigarette tax return by brand family schedule g. Tobacco products purchased in new jersey.

The new jersey information division of nicusa inc. 1948 as amended application is hereby made by the undersigned for a license to operate in the state of new jersey as a cigarette distributor or wholesale dealer for the year ending march 31 2012. Tobacco products tax return tpt 10 for periods on or after september 2018.

This requirement applies to profit and non profit corporations limited partnerships limited liability partnerships and limited. Nicusa nj will remit to the state of new jersey all payments and amounts owed to the state. The annual licensing period is april 1 through march 31.

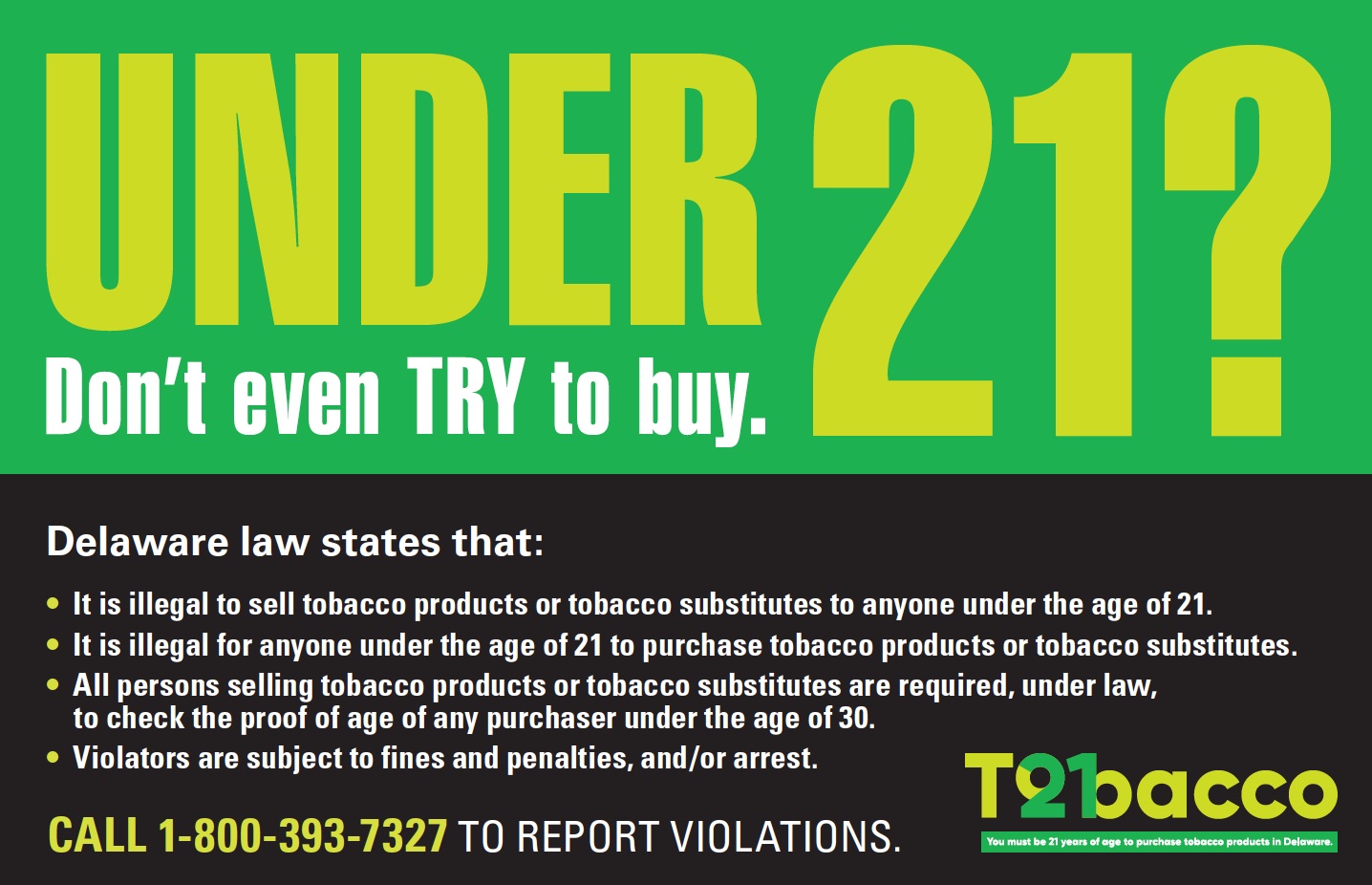

Nj code 2a170 514 nj code 2c33 131 the sale of tobacco andor any type of smoking device to someone under the age of 21 is prohibited. Initially in june 1999 the new jersey legislature enacted the model statute njsa. To receive your cigarette license you must enter information.

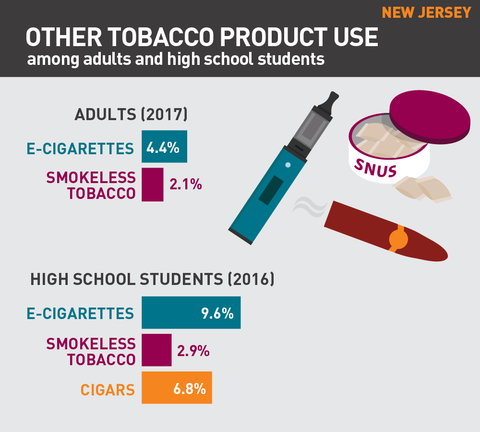

Tobacco industry in the us is the most regulated and administered industry. In addition the msa effectively changed how tobacco companies that sell cigarettes and roll your own tobacco can do business in new jersey. In compliance with chapter 65 pl.

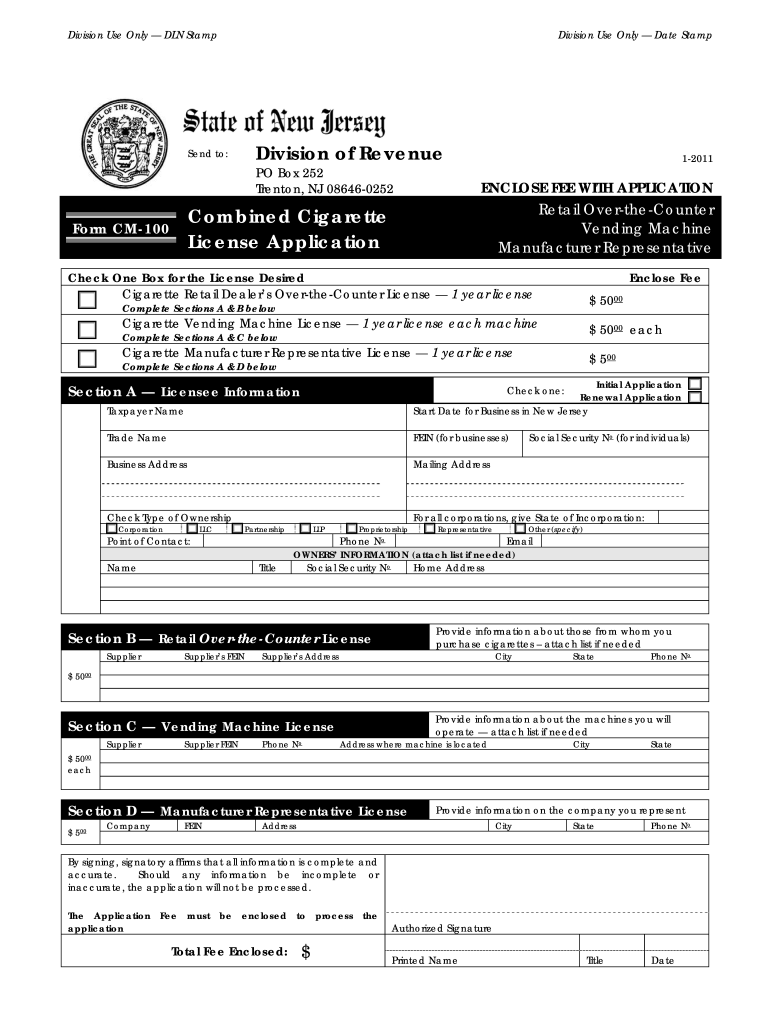

Sales deliveries and transfers of. State of new jersey tobacco regulations click on the regulation citations to review each in full. The annual fee for a manufacturers representative license is 5.

Tobacco products sold in a non taxable manner. Fee of 350 is herewith enclosed for a distributors license or 250 for a wholesale dealers license. The annual fee for a retailer or vending machine license is 50 per location.

No state or federal taxes will be taken out of your stimulus check and any stimulus money received does not affect your 2020 tax return. Resident distributors cigarette tax return. Non new jersey stamped cigarettes purchased.

New jersey cannot provide any information about the amount eligibility or when you may receive a payment. Official page of newark nj business license. The state of new jersey requires all sellers of cigarettes to be licensed.

Unstamped cigarettes received new jersey revenue stamps not affixed. Please visit the irs website for more information. Tobacco and vapor products tax wholesale exemption certificate.