State Of New Jersey Tax Refund

State Of New Jersey Tax Refund, Indeed recently has been hunted by consumers around us, perhaps one of you personally. People now are accustomed to using the internet in gadgets to view video and image information for inspiration, and according to the name of this article I will discuss about

If the posting of this site is beneficial to our suport by spreading article posts of this site to social media marketing accounts which you have such as for example Facebook, Instagram and others or can also bookmark this blog page.

Invent Employment History And Need Some Help With Payroll And Tax 125000 Federal Tax Calculator 2019 2020 201 Tax Refund Calculator Federal Taxes Tax Refund Jersey Vs Guernsey Cricket Match

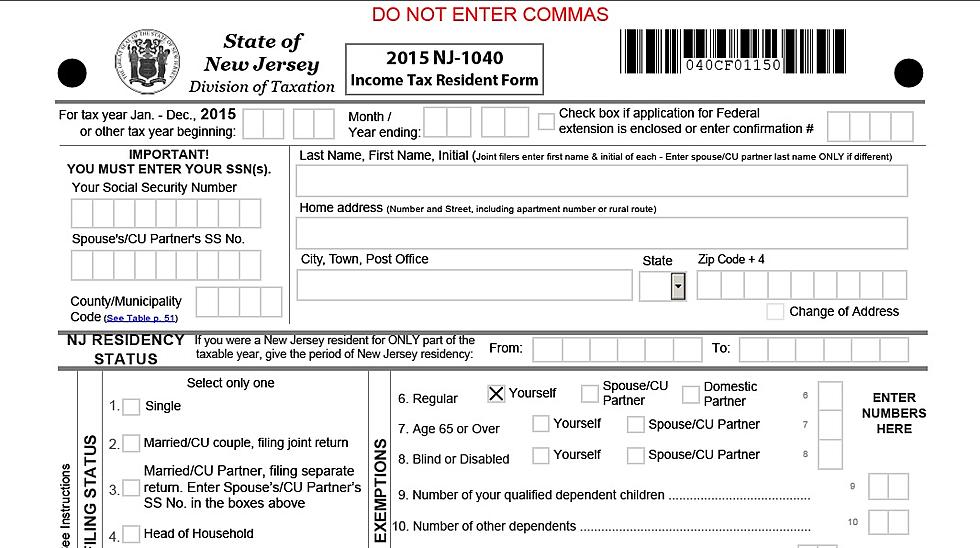

File an amended new jersey state tax return amended new jersey state returns must be printed out and mailed to the new jersey division of taxation.

Jersey vs guernsey cricket match. Non residents should use a form nj 1040nr and write the word amended in the upper right hand corner. New jersey cannot provide any information about the amount eligibility or when you may receive a payment. Checking for inconsistencies as well as math and other errors.

Please visit the irs website for more information. Ensuring that we transferred the information correctly. New jersey cannot provide any information about the amount eligibility or when you may receive a payment.

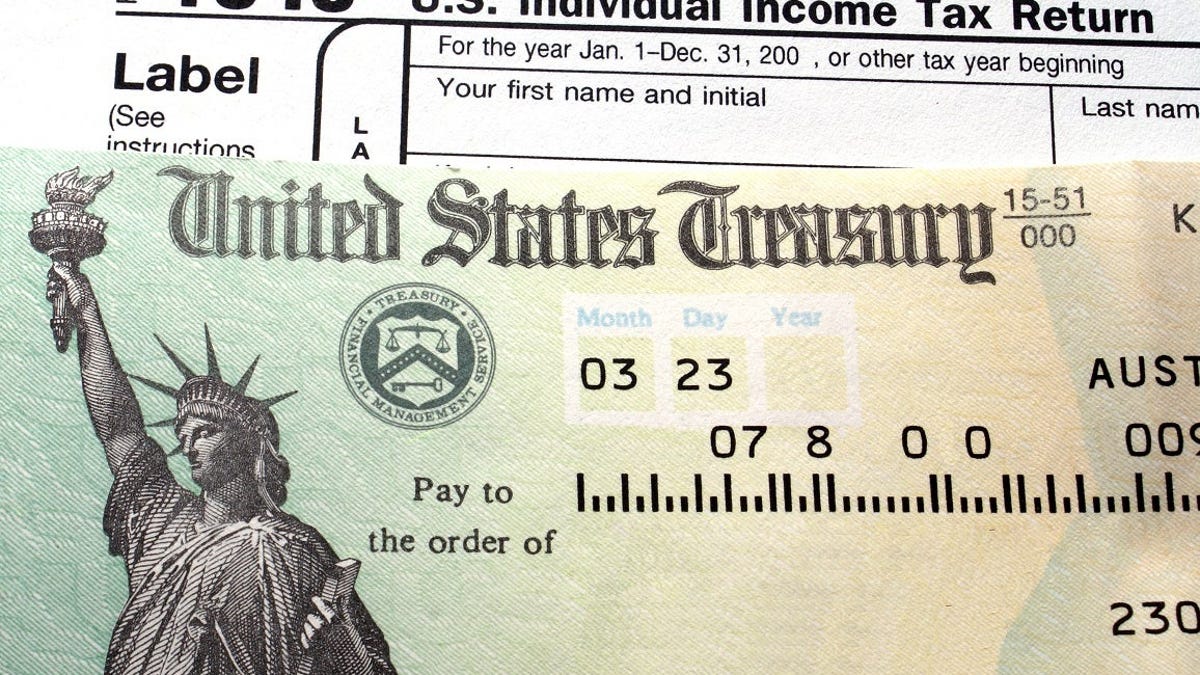

No state or federal taxes will be taken out of your stimulus check and any stimulus money received does not affect your 2020 tax return. No state or federal taxes will be taken out of your stimulus check and any stimulus money received does not affect your 2020 tax return. Please visit the irs website for more information.

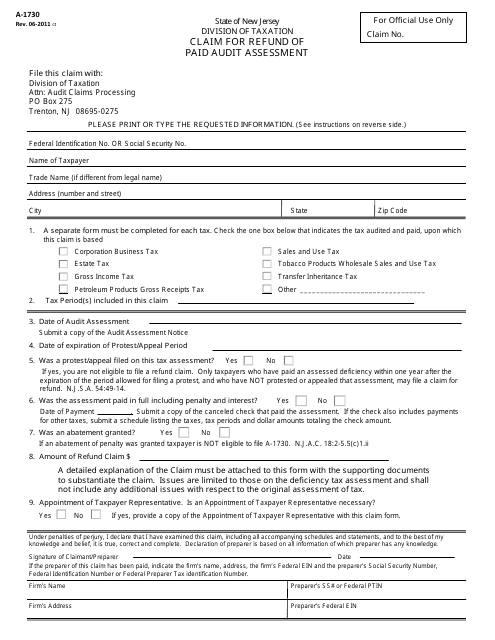

An automated script will lead you through the steps necessary to determine the amount of your tax refund. New jersey state tax refund status information. Taxpayers who have access to a touch tone phone may dial 1 800 323 4400 within new jersey new york pennsylvania delaware and maryland or 609 826 4400 anywhere to learn the status of their tax refund.

No state or federal taxes will be taken out of your stimulus check and any stimulus money received does not affect your 2020 tax return. How new jersey processes income tax refunds. New jersey cannot provide any information about the amount eligibility or when you may receive a payment.

Nj residents need to file a form nj 1040x. Please visit the irs website for more information. Transferring information from returns to new jerseys automated processing system.

New jersey cannot provide any information about the amount eligibility or when you may receive a payment.

:max_bytes(150000):strip_icc()/where-s-your-tax-refund-3193203-v4-5b688dc546e0fb004fc28d4e.png)