State Of New Jersey Sales Tax Online

State Of New Jersey Sales Tax Online, Indeed recently has been hunted by consumers around us, perhaps one of you personally. People now are accustomed to using the internet in gadgets to view video and image information for inspiration, and according to the name of this article I will discuss about

If the posting of this site is beneficial to our suport by spreading article posts of this site to social media marketing accounts which you have such as for example Facebook, Instagram and others or can also bookmark this blog page.

New jersey resident gabriel bought 1000 in taxable goods before january 1 2018 from the catalog of an out of state company that collected no sales taxes on the purchase.

Jersey blue fromage. New jersey cannot provide any information about the amount eligibility or when you may receive a payment. Sales and use tax. You cant view information on past filings and payments.

No state or federal taxes will be taken out of your stimulus check and any stimulus money received does not affect your 2020 tax return. Information about the new sales tax partial exemption and cap effective february 1 2016. When i try to file online and make my quarterly sales tax payment by e check the system will not let me enter todays date as the settlement date.

Call the division of taxation at 609 292 6400 if you need help or have questions. Please visit the irs website for more information. Gasoline purchases are not subject to the new jersey sales tax but a gasoline excise tax does apply.

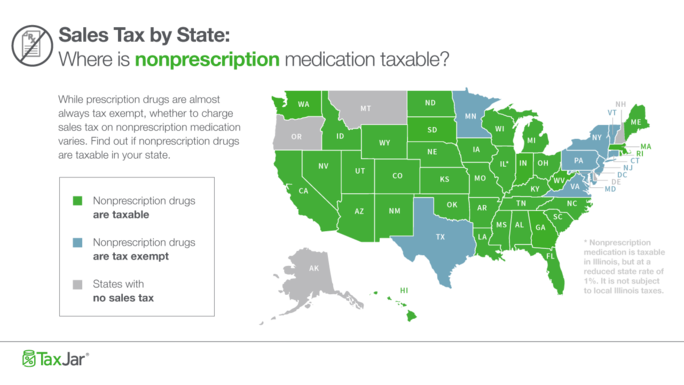

File or pay online. Cape may county tourism sales tax and tourism assessment. If you sell items online it is important you keep track of the different rules for different states as each state has its own rules and procedures for the collection of internet sales tax.

New jersey cannot provide any information about the amount eligibility or when you may receive a payment. In the wake the new legislation retailers that have an economic activity known as an economic nexus in a state can be obliged collect sales tax. File and pay taxes only.

Please visit the irs website for more information. Information about the new sales tax partial exemption and cap effective february 1 2016. Log in using your new jersey tax identification number and business name.

Certain businesses located within urban enterprise zones including salem county are required to only collect a reduced sales tax of 50 the state sales tax rate 350. 6875 was the new jersey sales tax rate in effect at the time of purchase. Combined atlantic city luxurystate sales tax.

Today is the due date. Items such as groceries household paper products medicine and clothes are exempt from all sales taxes. Sales tax collection schedule 6875 effective 01012017.

No state or federal taxes will be taken out of your stimulus check and any stimulus money received does not affect your 2020 tax return. Sales and use tax. New jersey sales and use tax energy return return periods beginning july 15 2006 through december 31 2016 sales and use tax.

This option allows you to file and pay taxes only.