State Of New Jersey Sales Tax Filing

State Of New Jersey Sales Tax Filing, Indeed recently has been hunted by consumers around us, perhaps one of you personally. People now are accustomed to using the internet in gadgets to view video and image information for inspiration, and according to the name of this article I will discuss about

If the posting of this site is beneficial to our suport by spreading article posts of this site to social media marketing accounts which you have such as for example Facebook, Instagram and others or can also bookmark this blog page.

No state or federal taxes will be taken out of your stimulus check and any stimulus money received does not affect your 2020 tax return.

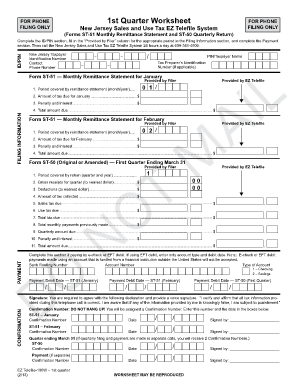

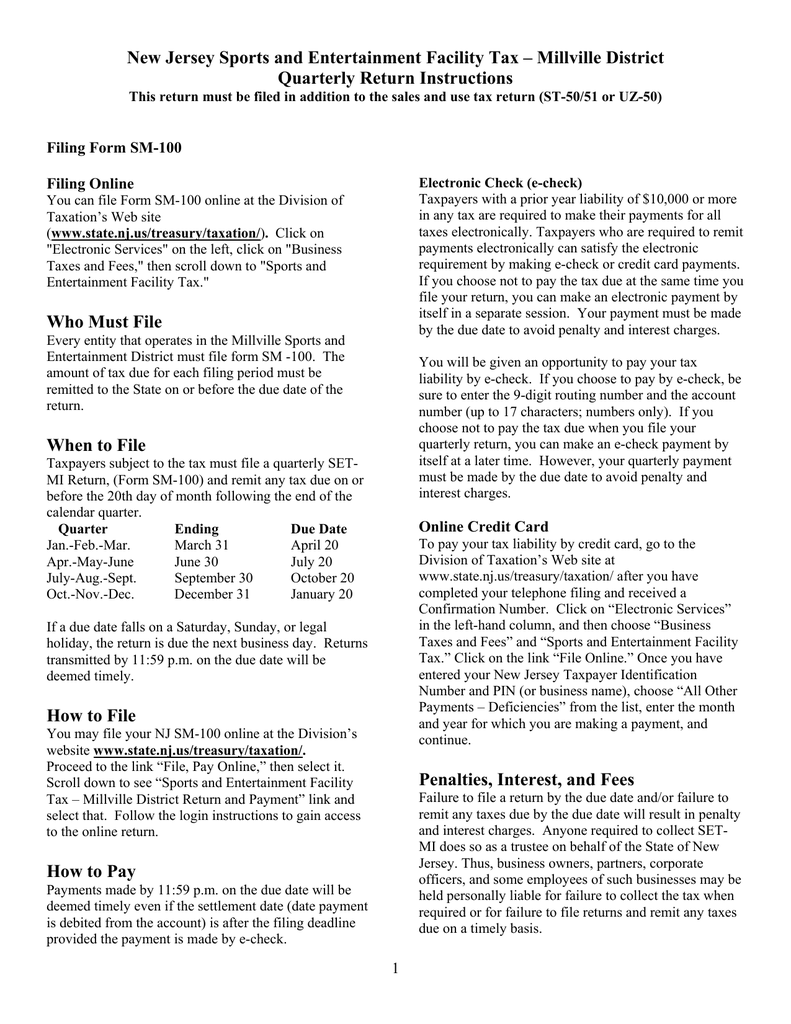

New jersey cricket league. If you collected 30000 or less in new jersey sales and use tax in the prior calendar year do not file form st 51 for the first or second month of any quarter. Log in using your new jersey tax identification number and business name. File or pay online.

The new jersey state login and state password. Combined atlantic city luxurystate sales tax. Cape may county tourism sales tax and tourism assessment.

Call the division of taxation at 609 292 6400 if you need help or have questions. Any 2nd quarter payments made after june 15 will be considered late and may be subject to interest charges. Weve done the work for you and compiled a list of helpful links videos and resources to make filing your first sales tax return easier.

You cant view information on past filings and payments. Information about the new sales tax partial exemption and cap effective february 1 2016. New jersey cannot provide any information about the amount eligibility or when you may receive a payment.

This option allows you to file and pay taxes only. Please visit the irs website for more information. File or pay online.

The username and password you provide for autofile should be associated with your new jersey sales and use tax account number. Information about the new sales tax partial exemption and cap effective february 1 2016. These details should not be associated with other types of.

File and pay taxes only. New jersey knows that filing a sales tax return can be hard so they provide resources to business owners to help teach you how to file.