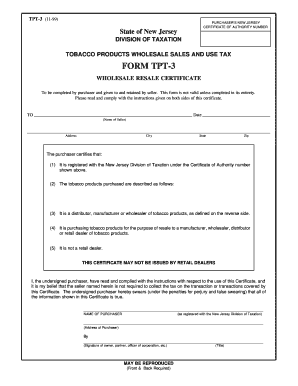

State Of New Jersey Resale Certificate

State Of New Jersey Resale Certificate, Indeed recently has been hunted by consumers around us, perhaps one of you personally. People now are accustomed to using the internet in gadgets to view video and image information for inspiration, and according to the name of this article I will discuss about

If the posting of this site is beneficial to our suport by spreading article posts of this site to social media marketing accounts which you have such as for example Facebook, Instagram and others or can also bookmark this blog page.

State of new jersey division of taxation sales tax form st 3nr resale certificate for non new jersey sellers for use only by out of state sellers not required to be registered in new jersey this form is not valid unless fully completed please read and comply with instructions on both sides of this certificate.

Dog football jersey custom. Sales and use tax. For public contracting as proof of valid business registration with the new jersey division of revenue. However the division of taxation recommends the certificate be updated every few years to ensure the customers information is up to date.

New jersey resale certificates dont expire. Sales and use tax. Does a new jersey resale certificate expire.

Seller should read and comply with the instructions given on both sides of an exemption certificate. Sales and use tax. A business registration certificate serves two purposes.

Vessel dealer sales and use. In general new jerseys st 3 resale certification requires the purchaser to provide their new jersey tax identification number but you can also provide a federal identification number or an out of state registration number when using the st 3nr resale certificate. Aircraft dealer sales and use tax exemption report.

Name of purchaser as registered with the new jersey division of taxation address of purchaser type of business by signature of owner partner officer of corporation etc title state of new jersey division of taxation sales tax form st 3 resale certificate to be completed by purchaser and given to and retained by. Motor vehicle sales and use tax exemption report. Resale certificate for non new jersey sellers.

Acceptance of uniform sales tax certificates in new jersey. State of new jersey division of taxation sales tax form st 3 resale certificate to be completed by purchaser and given to and retained by seller. See instructions on back.

Sales and use tax. New jersey does permit the use of a blanket resale certificate which means a single certificate on file with the vendor can be re used for all exempt purchases made from that vendor.