State Of New Jersey Inheritance Tax

State Of New Jersey Inheritance Tax, Indeed recently has been hunted by consumers around us, perhaps one of you personally. People now are accustomed to using the internet in gadgets to view video and image information for inspiration, and according to the name of this article I will discuss about

If the posting of this site is beneficial to our suport by spreading article posts of this site to social media marketing accounts which you have such as for example Facebook, Instagram and others or can also bookmark this blog page.

There is no extension of time to pay tax due.

Jersey design badminton. New jersey finally eliminated its estate tax but so far the state is hanging on to the inheritance tax. State inheritance taxes. New jerseyans love to hate the states inheritance tax.

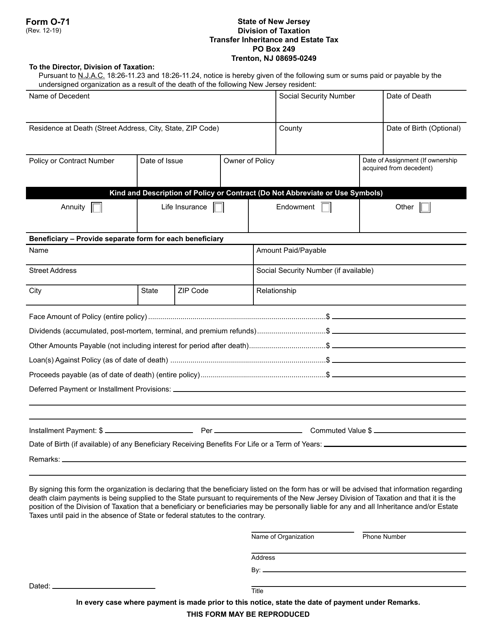

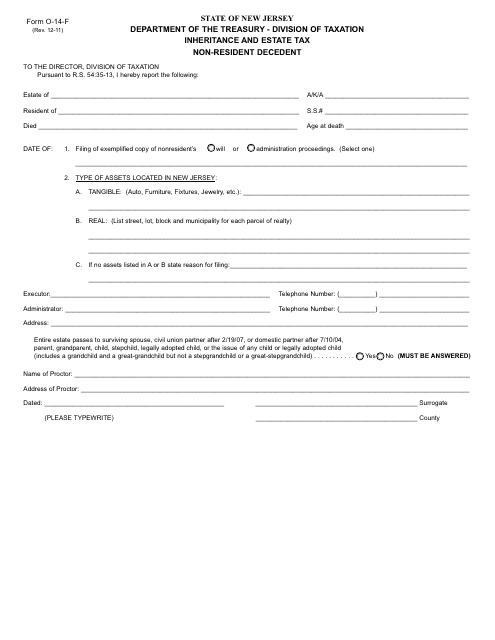

Tax is based on the credit for state inheritance estate succession or legacy taxes allowable under the provisions of the internal revenue code in effect on december 31 2001. The tax return along with copies of the will if any and the deceased persons last federal income tax return is filed with the new jersey division of. New jersey has had an inheritance tax since 1892 when a tax was imposed on property transferred from a deceased person to a beneficiary.

New jersey inheritance tax returns form it r if the deceased person was a new jersey resident instructions and current tax rates are available on the state division of taxation website. No new jersey estate tax return is required. However a new jersey estate tax return must be filed if the resident decedents gross estate plus adjusted taxable gifts exceeds 675000.

Iowa kentucky maryland nebraska new jersey and pennsylvania. You probably wont have to worry about an inheritance tax either because only six states collect this tax as of 2019.