State Of New Jersey Income Tax Refund

State Of New Jersey Income Tax Refund, Indeed recently has been hunted by consumers around us, perhaps one of you personally. People now are accustomed to using the internet in gadgets to view video and image information for inspiration, and according to the name of this article I will discuss about

If the posting of this site is beneficial to our suport by spreading article posts of this site to social media marketing accounts which you have such as for example Facebook, Instagram and others or can also bookmark this blog page.

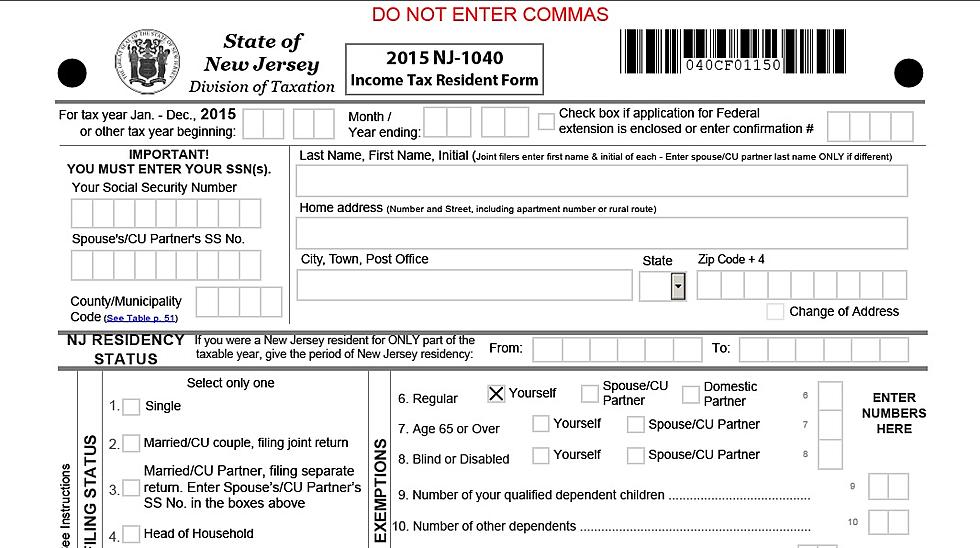

You are required to file a state income tax return if.

Jersey college id number. Nj income tax check on a refund. Ensuring that we transferred the information correctly. That includes living in new jersey for only part of the year.

Any 2nd quarter payments made after june 15 will be considered late and may be subject to interest charges. 2nd quarter estimated payments still due on june 15 2020 estimated tax payments for the 2nd quarter are still due on june 15 for both income tax and corporation business tax taxpayers. If you were a resident of new jersey for any part of the year you must file a new jersey state income tax return.

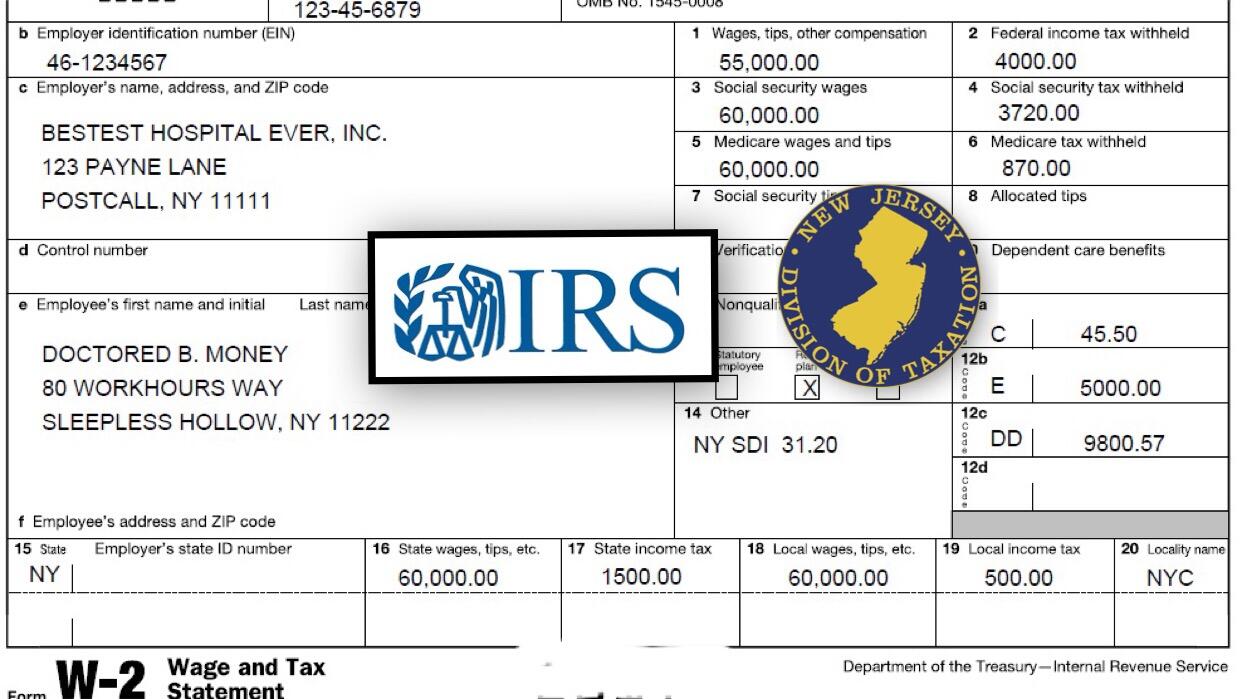

Social security number listed first on your tax return. You will owe personal income tax to new jersey on your new york wages even if your employer didnt withhold new jersey income tax from your pay. Checking for inconsistencies as well as math and other errors.

Both options are available 24 hours a day seven days a week. To receive a tax refund from the state of new jersey you must file a state tax return. 1 800 323 4400 toll free within nj ny pa de and md or 609 826 4400 anywhere.

To do so you must know the. Transferring information from returns to new jerseys automated processing system. Beginning in january we process individual income tax returns daily.

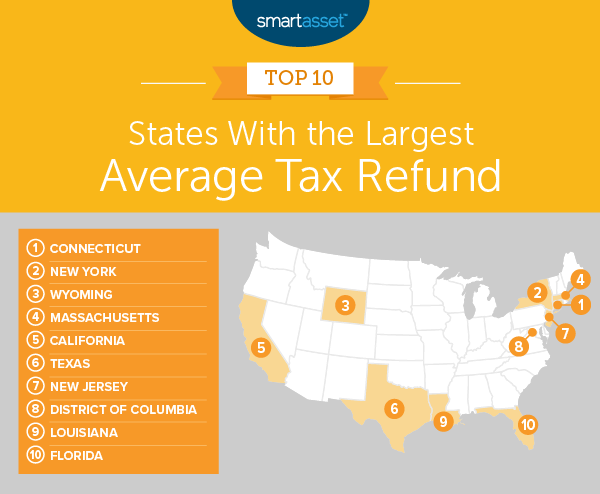

You could be eligible for a refund if you had nj income tax withheld paid estimated taxes or you qualify for certain tax credits. How new jersey processes income tax refunds. Exact amount of your refund.

Check the status of your refund. Residents of new jersey. 2018 or 2019 refunds only.