State Of New Jersey Form L 8

State Of New Jersey Form L 8, Indeed recently has been hunted by consumers around us, perhaps one of you personally. People now are accustomed to using the internet in gadgets to view video and image information for inspiration, and according to the name of this article I will discuss about

If the posting of this site is beneficial to our suport by spreading article posts of this site to social media marketing accounts which you have such as for example Facebook, Instagram and others or can also bookmark this blog page.

The state of new jerseys official web site is the gateway to nj information and services for residents visitors and businesses.

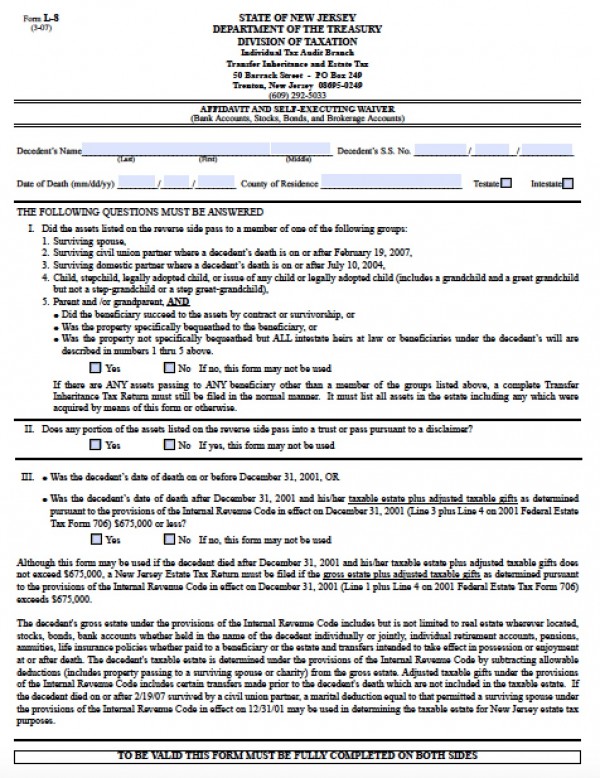

World cup team jersey 2019. A new jersey estate tax return must be filed if the gross estateplus adjusted taxable gifts exceeds 675000 as. New jersey cannot provide any information about the amount eligibility or when you may receive a payment. Form l 8 is used to secure the release of bank accounts stocks bonds and brokerage accounts.

State of new jersey department of the treasury division of taxation transfer inheritance and estate tax form l 8 01 17 self executing waiver affidavit bank accounts stocks bonds and brokerage accounts. State of new jersey department of the treasury division of taxation individual tax audit branch transfer inheritance and estate tax 50 barrack street po box 249 trenton new jersey 08695 0249 609 292 5033 form l 8 3 07 affidavit and self executing waiver bank accounts stocks bonds and brokerage accounts. The new jersey estate tax is based upon the federal estate tax credit for state death taxes allowable under the provisions of.

You must be able to answer yes to either a b or c to qualify to use this form. Form l 8 may be used obtain the release of bank accounts brokerage accounts stock in a new jersey corporation and new jersey bonds. Banks are also required to honor any request by the estate representative or joint owner of an account to issue a checks made out to new jersey inheritance and estate tax for the tax payment as long as the funds are available in the account.

Form l 9 is used to secure the release of realty. Please visit the irs website for more information. A form l 9 may be used to obtain a tax waiver to transfer real.

1119 form l 9 affidavit for real property tax waiver. The remaining funds must be kept by the bank until a valid waiver or form l 8 is received. The new jersey estate tax is not affected by the domestic partnership act.

New jersey supplemental form to the multi jurisdictional personal history disclosure form casino service industry enterprise qualifiers. This section determines whether the estate may be required to pay new jersey estate tax. The nj poison control center and 211 have partnered with the state to provide information to the public on covid 19.

No state or federal taxes will be taken out of your stimulus check and any stimulus money received does not affect your 2020 tax return.