State Of New Jersey Employers Quarterly Report

State Of New Jersey Employers Quarterly Report, Indeed recently has been hunted by consumers around us, perhaps one of you personally. People now are accustomed to using the internet in gadgets to view video and image information for inspiration, and according to the name of this article I will discuss about

If the posting of this site is beneficial to our suport by spreading article posts of this site to social media marketing accounts which you have such as for example Facebook, Instagram and others or can also bookmark this blog page.

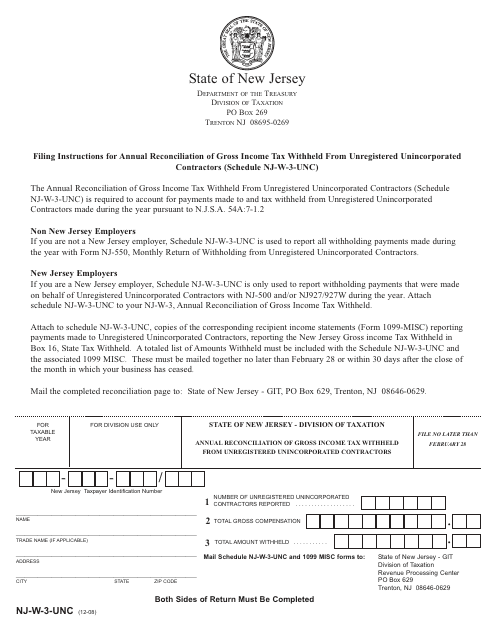

If you use this option you can file forms nj927 nj w 3with w 2 and 1099 and wr30 pay withholding taxes and view information on past filings and payments.

New jersey coronavirus numbers by county. 4321 7c6 of the new jersey unemployment compensation law. To make an additional contribution complete and return form uc 45 voluntary contribution report. Step 2 fill in the employers quarterly report you have been presented with your current prior or amended online filing form nj927 or nj927w.

Before using this service your business must already be registered with the state of new jersey 1. Employees withholding allowance certificate. Employers can choose to make additional contributions to have their experience ratings recalculated per rs.

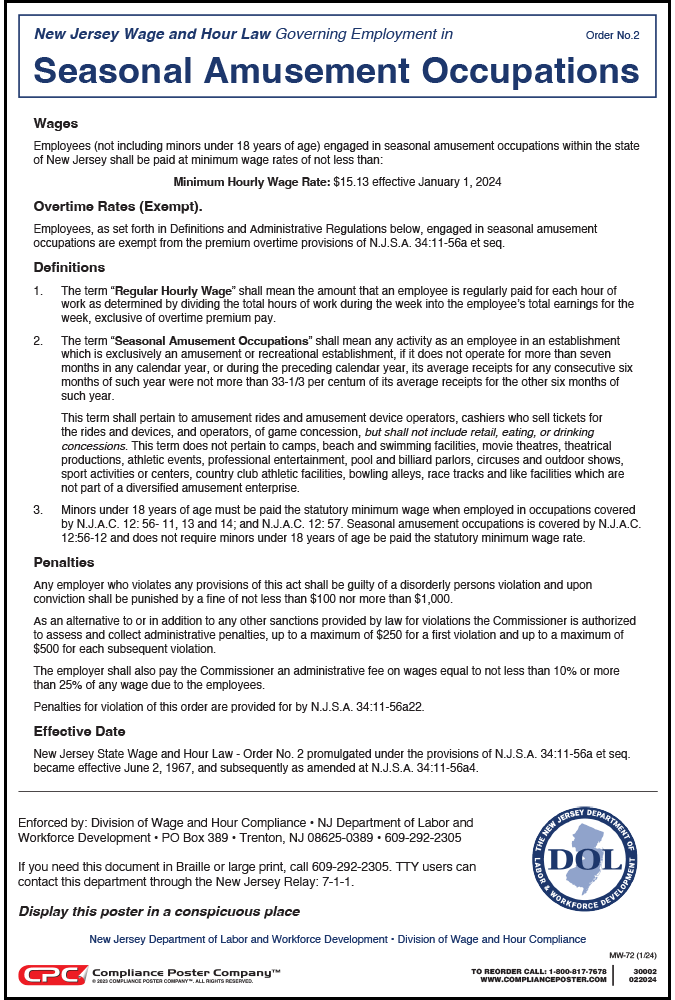

A notice to employers electronic filing mandate for employer year end filings and statements. File new jersey payroll tax returns submit wage reports and pay withholding taxes. Each monthly employment figure reported on the employers quarterly report form nj 927 should represent a count of all full time and part time workers covered by the nj unemployment insurance law who worked during or received pay for the payroll period that includes the 12th of the monthif no workers were employed during the payroll period enter zero 0 for the month.

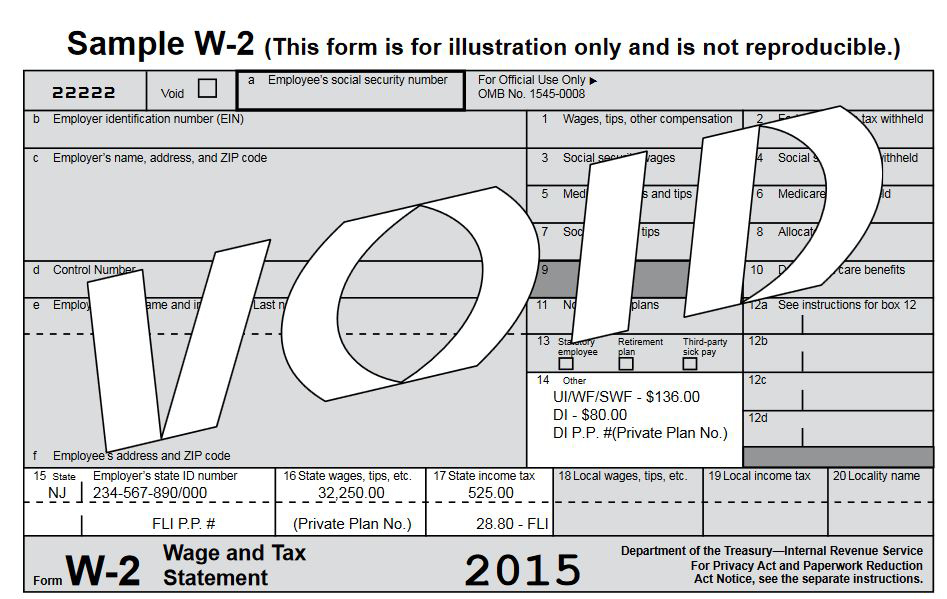

New jersey gross income tax instruction booklet and samples for employers payors of pension and annuity income and payors of gambling winnings rev.