State Of New Jersey 1099 G

State Of New Jersey 1099 G, Indeed recently has been hunted by consumers around us, perhaps one of you personally. People now are accustomed to using the internet in gadgets to view video and image information for inspiration, and according to the name of this article I will discuss about

If the posting of this site is beneficial to our suport by spreading article posts of this site to social media marketing accounts which you have such as for example Facebook, Instagram and others or can also bookmark this blog page.

New jersey cannot provide any information about the amount eligibility or when you may receive a payment.

South jersey craigslistcom. Form 1099 g does not include interest paid by new jersey on an overpayment. Enter the social security number that appears first on your new jersey gross income tax return the corresponding date of birth and the security code to begin the process. The state of new jersey does not mail form 1099 g certain government payments to report the amount of a state tax refund a taxpayer received.

If you are unable to access the self service system to obtain the 1099 g statement you can contact your reemployment call center to request a copy. State income tax refunds may be taxable income for federal purposes for individuals who itemized hisher deductions on hisher federal tax return in the previous year. They are issued by the division of unemployment insurance.

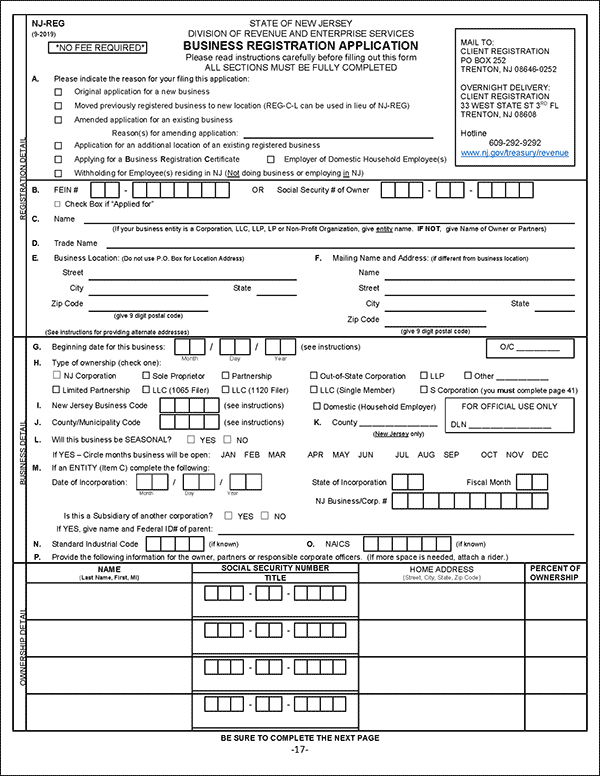

The nj poison control center and 211 have partnered with the state to provide information to the public on covid 19. Applied to a tax debt owed to new jersey another state or the internal revenue service irs. State of new jersey new jersey government state employment about nj nj business transportation.

Applied to a debt owed to another state agency child support past due student loans public defender etc. Please visit the irs website for more information. No state or federal taxes will be taken out of your stimulus check and any stimulus money received does not affect your 2020 tax return.

New jersey 1099 g inquiry. We do not issue form 1099 g statements for unemployment insurance benefits. Please visit the irs website for more information.

Although the state of new jersey does not tax unemployment insurance benefits they are subject to federal income taxes. Have general questions about covid 19. Back to top.

The tax form 1099 g will be issued in january and will cover the previous calendar year in which benefits were paid. Po box 046 trenton new jersey 08646 0046 or send correspondence electronically through our nj onrs system and explain why you believe the form 1099 g andor 1099 int is incorrect. No state or federal taxes will be taken out of your stimulus check and any stimulus money received does not affect your 2020 tax return.

Include the information necessary for us to provide a response name social security number tax year amounts contact information etc. Out of state claimants may call. To help offset your future tax liability you may voluntarily choose to have 10 percent of your weekly unemployment insurance benefits withheld and sent to the internal revenue service irs.

They are issued by the division of unemployment insurance.