New Jersey Unemployment Withholding Rates

New Jersey Unemployment Withholding Rates, Indeed recently has been hunted by consumers around us, perhaps one of you personally. People now are accustomed to using the internet in gadgets to view video and image information for inspiration, and according to the name of this article I will discuss about

If the posting of this site is beneficial to our suport by spreading article posts of this site to social media marketing accounts which you have such as for example Facebook, Instagram and others or can also bookmark this blog page.

Rates range from 04 54 on the first 35300 for 2020.

New jersey volleyball clubs. Nj income tax tax rates gross income tax. In new jersey unemployment taxes are a team effort. Unemployment and temporary disability contribution rates in new jersey are assigned on a fiscal year basis july 1 st to june 30.

Tax table 2018 and after returns tax table 2017 and prior returns if your new jersey taxable income is less than 100000 you can use the new jersey tax table or new jersey rate schedules. Employee and employer state unemployment insurance tax rates will apply to the first 34400 of an employees earnings in 2019 up from 33700 in 2018. All new employers except successors are assigned new employer rates for the first three calendar years after which a calculated rate is assigned based on employment experience.

The employee withholding rate will decrease to 0. New jersey unemployment tax. New jersey fiscal year 2019 sui rates decreased.

New jersey unemployment tax. As we previously reported employer sui tax rates range from 04 to 54 on rate schedule b for fy 2019 july 1 2018 through june 30 2019 down from 05 to 58 on rate schedule c for fy 2018 2018 july 1 2017 through june 30 2018. Employers the wage base.

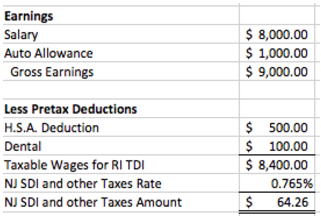

Beginning january 1 2019 the withholding rate on income over five million dollars is 118 percent. The 2020 employeremployee sui taxable wage base increases to 35300 up from 34400 for calendar year 2019. These amounts are used when the employer does not assign a value to such payments.

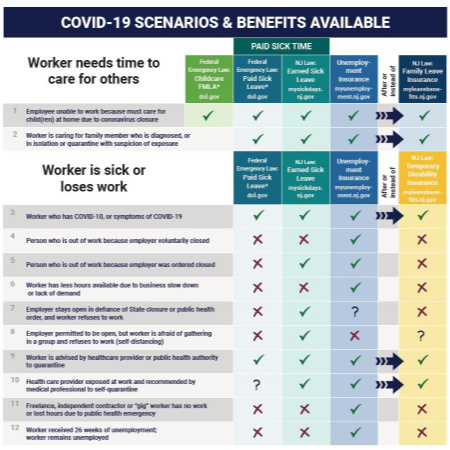

You can opt to have federal income tax withheld when when you first apply for benefits. The 118 tax rate applies to individuals with taxable income over 5000000. Telecommuter covid 19 employer and employee faq.

The 118 tax rate applies to individuals with taxable income over 5000000. The withholding tax rates for 2019 reflect graduated rates from 15 to 118. Free paycheck and tax calculators.

The new jersey department of labor and workforce development released the calendar year 2020 taxable wage bases used for state unemployment insurance sui temporary disability insurance tdi and family leave insurance fli. Tele commuting and corporate nexus as a result of covid 19 causing people to work from home as a matter of public health safety and welfare the division will temporarily waive the impact of the legal threshold within njsa. The wage base increases to 34400 for 2019.

New employers pay 05. If youre a new employer youll pay a flat rate of 28. Unemployment insurance new jersey workforce development and health care subsidy fund taxes.

For 2019 employees are subject to a 00425 000425 workforce development partnership fund tax. You can also select or change your withholding status at any time by writing to the new jersey department of labor and workforce development unemployment insurance po box 908 trenton nj 08625 0908. 187 19a which treats the presence of employees working from their homes in new jersey as.

Free paycheck and tax calculators. New jersey gross income tax.