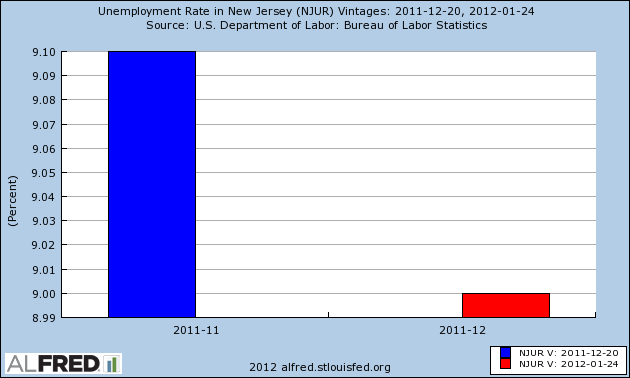

New Jersey Unemployment Tax

New Jersey Unemployment Tax, Indeed recently has been hunted by consumers around us, perhaps one of you personally. People now are accustomed to using the internet in gadgets to view video and image information for inspiration, and according to the name of this article I will discuss about

If the posting of this site is beneficial to our suport by spreading article posts of this site to social media marketing accounts which you have such as for example Facebook, Instagram and others or can also bookmark this blog page.

If you have employees in any of these three states you will withhold the tax from their wages and remit the tax to the state.

Dodgers jersey in black. Auxiliary aids and services are available upon request to assist individuals with disabilities. Under new jersey law. Both a federal and new jersey earned income tax credit njeitc are available to eligible taxpayers.

Like the federal credit the njeitc can reduce the amount of tax you owe or increase the amount of your refund check. Without the option to withhold taxes from the 600 payments workers could be are looking at a federal tax bill of. New jersey does not tax unemployment benefits but the federal government does.

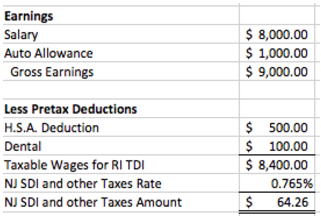

Depending on the type of business where youre doing business and other specific regulations that may apply there may be multiple government agencies that you must contact in order to get a new jersey unemployment insurance tax. You can also select or change your withholding status at any time by writing to the new jersey department of labor and workforce development unemployment insurance po box 908 trenton nj 08625 0908. The 2020 employeremployee sui taxable wage base increases to 35300 up from 34400 for calendar year 2019.

However employees in three states alaska new jersey and pennsylvania are subject to state unemployment tax withholding. New jersey unemployment compensation and temporary disability benefits laws. At the time of publication a new employer in jew jersey pays a tax rate of 26825 for unemployment 005 for disability insurance and 001175 for workforce development and the annual wage base is 29600.

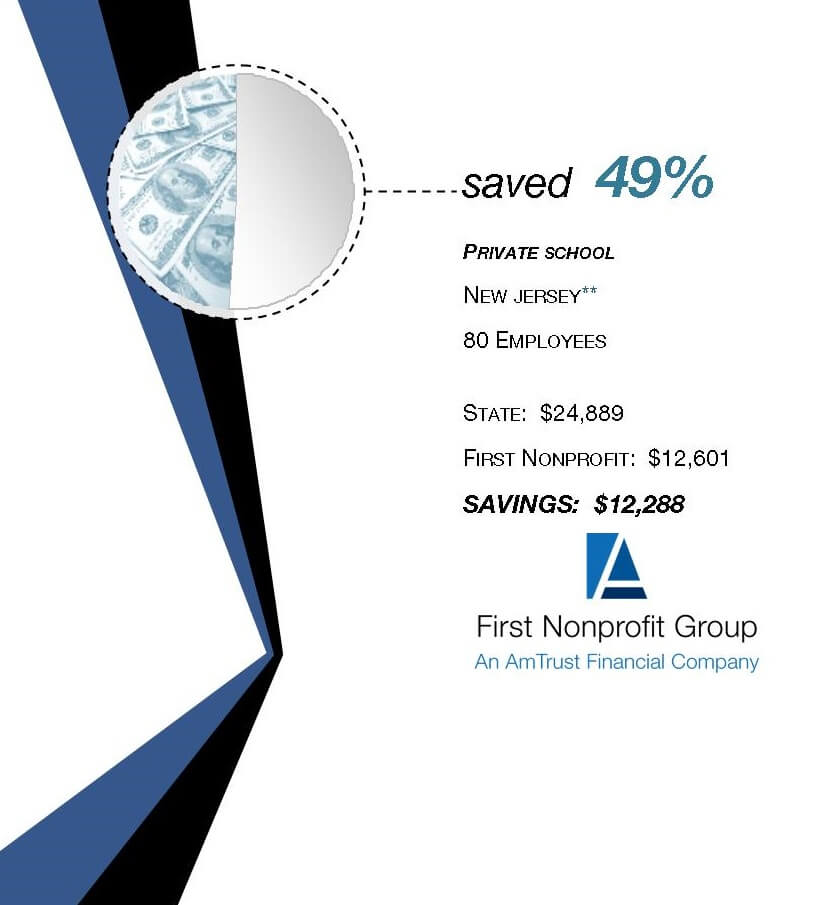

A new jersey unemployment insurance tax registration can only be obtained through an authorized government agency. Although all new employers pay the same amount of unemployment taxes for the first three years their tax rates may increase or decrease depending on the number of employees who file for unemployment benefits. Any questions or problems you may have about the information contained in this handbook should be directed to the appropriate office of the new jersey department of labor and workforce development.

Workers who are eligible for the federal credit also qualify for the njeitc. Your employers state unemployment tax rate depends on whether hes a new employer and his unemployment benefits history. You can opt to have federal income tax withheld when when you first apply for benefits.