New Jersey Unemployment Pay Rate

New Jersey Unemployment Pay Rate, Indeed recently has been hunted by consumers around us, perhaps one of you personally. People now are accustomed to using the internet in gadgets to view video and image information for inspiration, and according to the name of this article I will discuss about

If the posting of this site is beneficial to our suport by spreading article posts of this site to social media marketing accounts which you have such as for example Facebook, Instagram and others or can also bookmark this blog page.

If youre a new employer youll pay a flat rate of 28.

What new jersey lottery is tonight. Unemployment and temporary disability contribution rates in new jersey are assigned on a fiscal year basis july 1 st to june 30. The new jersey department of labor and workforce development determines your unemployment benefit rate based on. Our journalism needs your support.

Both employers and employees contribute. The 2020 employeremployee sui taxable wage base increases to 35300 up from 34400 for calendar year 2019. New employers pay 05.

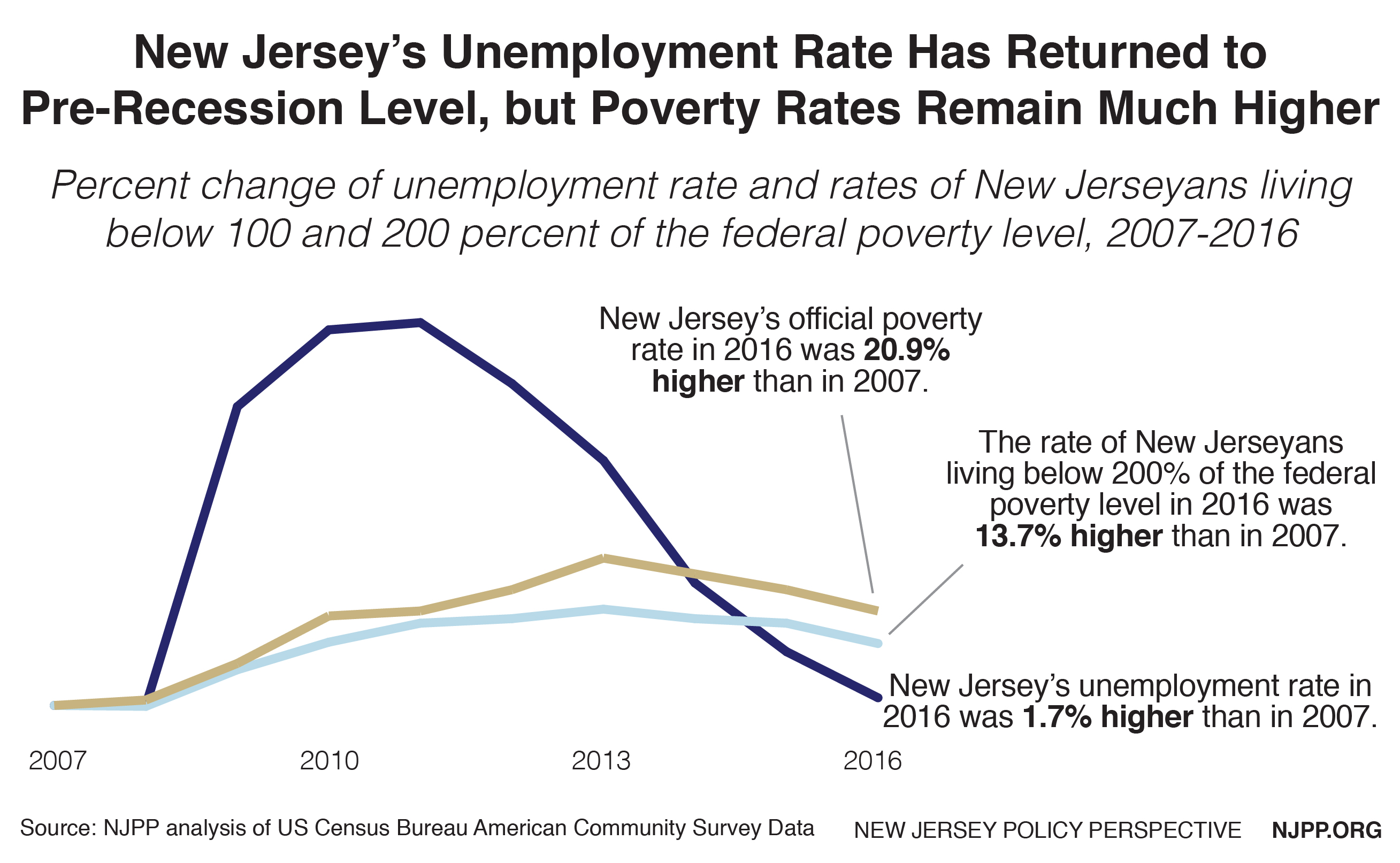

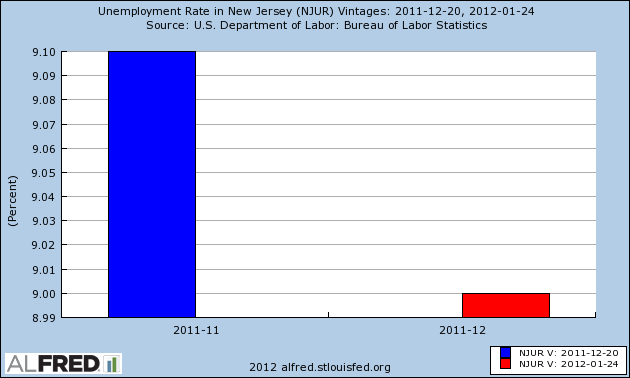

And new jerseys unemployment rate fell in july to 138 the bls announced with about 341000 jobs regained since a low point in april or about 41 of jobs lost due to the pandemic. New jersey these occupational employment and wage estimates are calculated with data collected from employers in all industry sectors in new jersey. Rates range from 04 54 on the first 35300 for 2020.

Jobless workers in every state get this extra 600 a week through july 31 2020 on top of what the unemployed receive from their regular state unemployment benefits. Additional information including the hourly and annual 10th 25th 75th and 90th percentile wages and the employment percent relative standard error is available in the downloadable xls file. In new jersey unemployment taxes are a team effort.

If new jersey had to pay an additional 100 per person it could cost the state 68 million a week if the states unemployment rate stays where it is today. Maximum unemployment pay varies state by state and the average unemployment benefit is 385 per week nationwide according to the center on budget and policy priorities. Your weekly benefit rate which is 60 of your average weekly wage up to the maximum benefit amount which is 713 in 2020.

The majority of states have been approved to issue an extra 300 weekly federal unemployment benefit for at least three weeks. The weekly benefit rate is capped at a maximum amount based on the state minimum wage. We will calculate your weekly benefit rate at 60 of the average weekly wage you earned during the base year up to that maximumwe determine the average weekly wage based on wage information your employers report.

For 2020 the maximum weekly benefit rate is 713.