New Jersey Unemployment Insurance Employer

New Jersey Unemployment Insurance Employer, Indeed recently has been hunted by consumers around us, perhaps one of you personally. People now are accustomed to using the internet in gadgets to view video and image information for inspiration, and according to the name of this article I will discuss about

If the posting of this site is beneficial to our suport by spreading article posts of this site to social media marketing accounts which you have such as for example Facebook, Instagram and others or can also bookmark this blog page.

Google translate is an online service for which the user pays nothing to obtain a purported language translation.

Basketball jersey design apps. The state of nj site may contain optional links information services andor content from other websites operated by third parties that are provided as a convenience such as google translate. General unemployment insurance information or further assistance this office may refer you to the proper office to handle your. Completing your new jersey unemployment insurance for employers calculations is easy but it provides an opportunity for some employers to reevaluate their current tax and wage reporting practices.

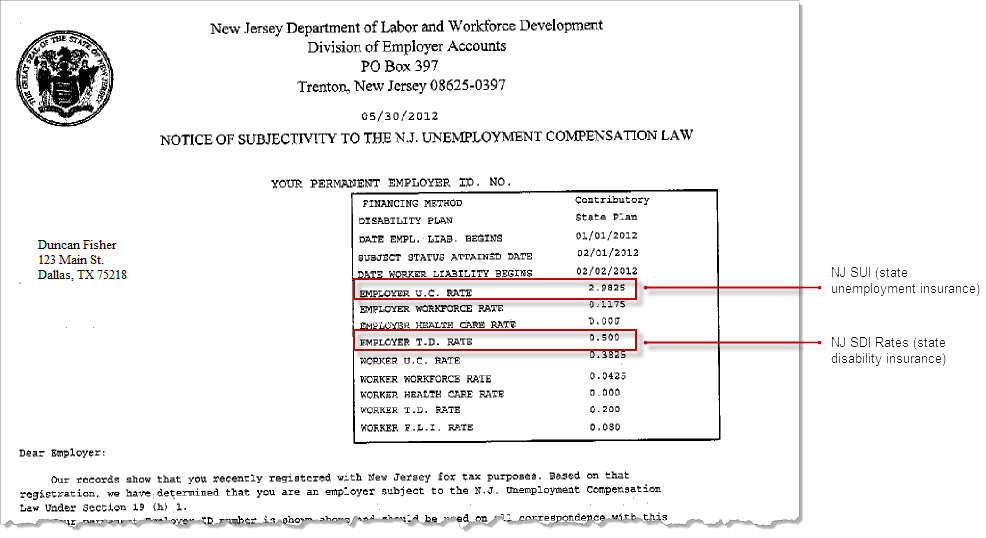

Employers pay this insurance to ensure there is a robust pool of funds for these unemployed workers to draw from. At the time of publication a new employer in jew jersey pays a tax rate of 26825 for unemployment 005 for disability insurance and 001175 for workforce development and the annual wage base is 29600. Rules for unemployment insurance tax liability.

Your employers state unemployment tax rate depends on whether hes a new employer and his unemployment benefits history. All new employers except successors are assigned new employer rates for the first three calendar years after which a calculated rate is assigned based on employment experience. The state of nj site may contain optional links information services andor content from other websites operated by third parties that are provided as a convenience such as google translate.

The employer is subject to the federal unemployment tax act futa or. Trenton new jersey 08625 0058 609 984 2296 fax. New jersey state unemployment insurance.

Division of unemployment insurance labor dispute investigation po box 058 trenton new jersey 08625 0058 609 984 2296 fax. If you voluntarily quit your job for reasons that were not work related or you were terminated for misconduct your eligibility will need to be reviewed. The new jersey department of labor and workforce development is an equal employment opportunity employer and provides equal opportunity programs.

The employer acquires another business that is already subject to new jerseys ui tax law. New jersey unemployment insurance benefits are meant for people who lose their job through no fault of their own such as an employers lack of work or a layoff due to downsizing. In new jersey most for profit employers are liable for state ui taxes if one of the following is true.

Unemployment and temporary disability contribution rates in new jersey are assigned on a fiscal year basis july 1 st to june 30.

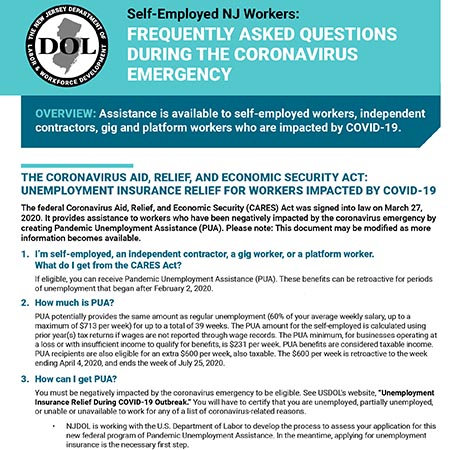

Https Myunemployment Nj Gov Labor Myunemployment Assets Pdfs Ui Process Selfemployed Pdf Basketball Jersey Design Apps