New Jersey Unemployment Disability

New Jersey Unemployment Disability, Indeed recently has been hunted by consumers around us, perhaps one of you personally. People now are accustomed to using the internet in gadgets to view video and image information for inspiration, and according to the name of this article I will discuss about

If the posting of this site is beneficial to our suport by spreading article posts of this site to social media marketing accounts which you have such as for example Facebook, Instagram and others or can also bookmark this blog page.

The pr 1 poster unemployment disability insurance is a labor law posters poster by the new jersey department of labor and workforce development.

Jersey mikes franchise cost. Any period when you receive full salary or paid time off. Back to top. New jerseys temporary disability and family leave insurance programs get more information check claim status or apply for benefits.

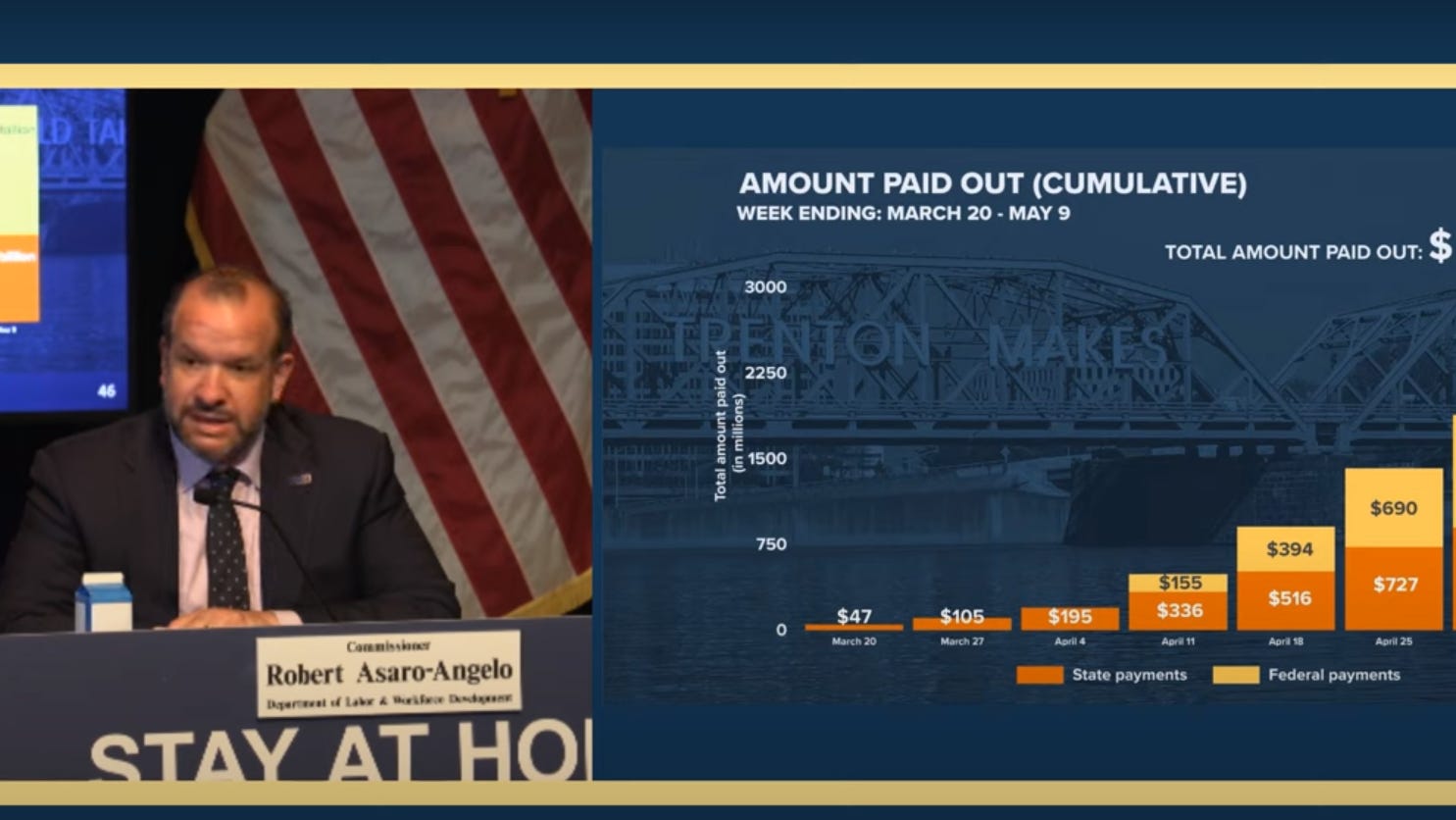

This is a mandatory posting for all employers in new jersey and businesses who fail to comply may be subject to fines or sanctions. Your employers state unemployment tax rate depends on whether hes a new employer and his unemployment benefits history. Trenton the new jersey department of labor and workforce development announced that it would begin providing 20 weeks of extended unemployment this week to new jersey workers who have exhausted their state and federal jobless benefits.

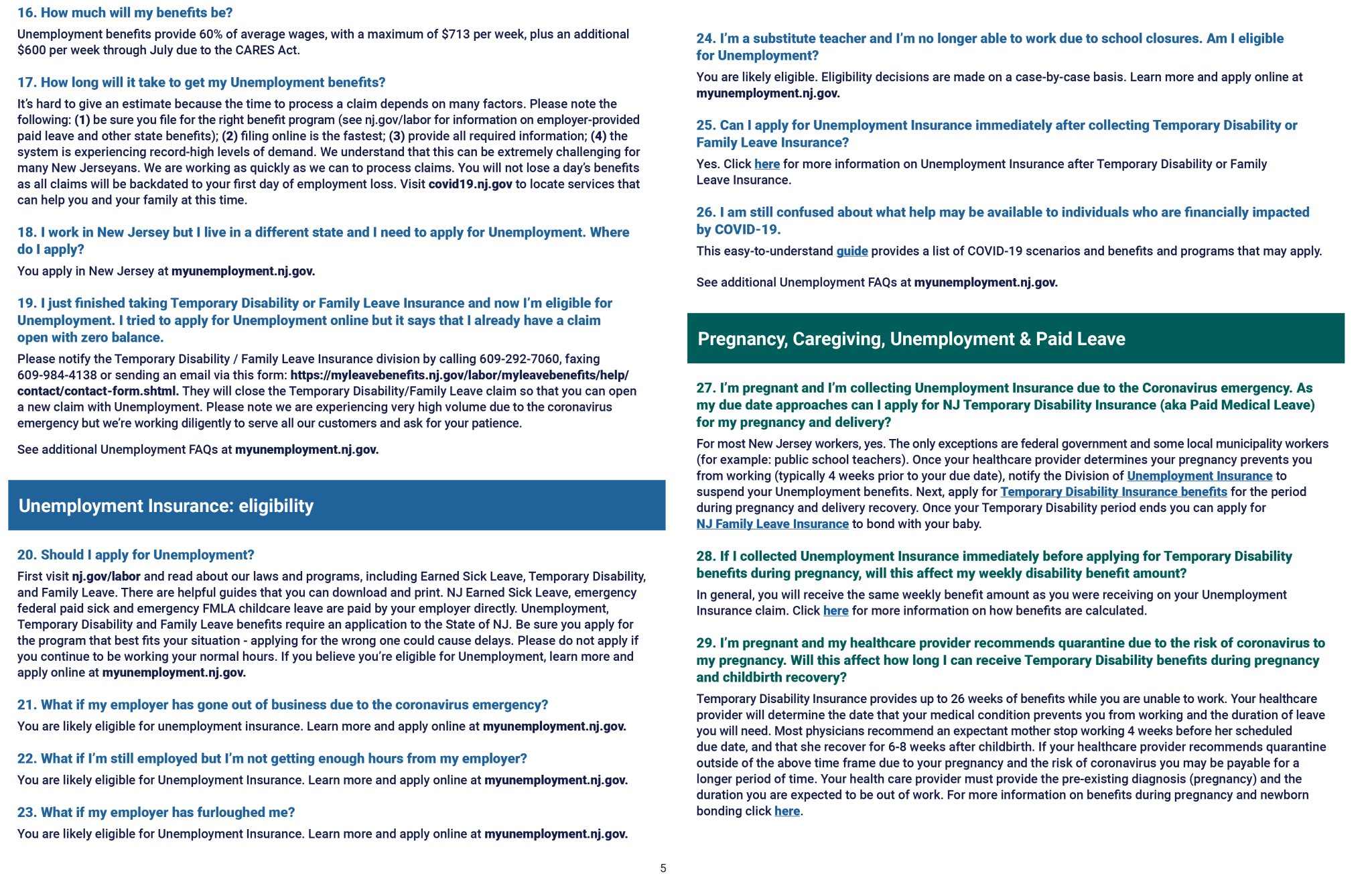

The law simplified the basic eligibility requirements. Division of unemployment insurance provides services and benefits to. Official site of the state of new jersey.

The new jersey department of labor and workforce development released the calendar year 2020 taxable wage bases used for state unemployment insurance sui temporary disability insurance tdi and family leave insurance fli. New jersey pr 1 poster unemployment disability insurance required. The state extension kicks in after claimants exhaust up to 26 weeks of state unemployment plus 13 weeks of federal.

Any period that you receive unemployment insurance benefits family leave insurance benefits any benefits from a disability or cash sickness program or similar law of new jersey or any other state or the federal government. At the time of publication a new employer in jew jersey pays a tax rate of 26825 for unemployment 005 for disability insurance and 001175 for workforce development and the annual wage base is 29600. On january 29 2001 chapter 17 pl.

Governor phil murphy. The 2020 employeremployee sui taxable wage base increases to 35300 up from 34400 for calendar year 2019. New jerseys wage bases for the unemployment insurance temporary disability insurance and family leave insurance programs are to increase in 2021 the state department of labor and workforce development said aug.

The state of nj site may contain optional links information services andor content from other websites operated by third parties that are provided as a convenience such as google translate.