How Much Does New Jersey Unemployment Pay

How Much Does New Jersey Unemployment Pay, Indeed recently has been hunted by consumers around us, perhaps one of you personally. People now are accustomed to using the internet in gadgets to view video and image information for inspiration, and according to the name of this article I will discuss about

If the posting of this site is beneficial to our suport by spreading article posts of this site to social media marketing accounts which you have such as for example Facebook, Instagram and others or can also bookmark this blog page.

Unemployment Insurance Taxes Options For Program Design And Insolvent Trust Funds Tax Foundation Netherlands Womens Football Jersey

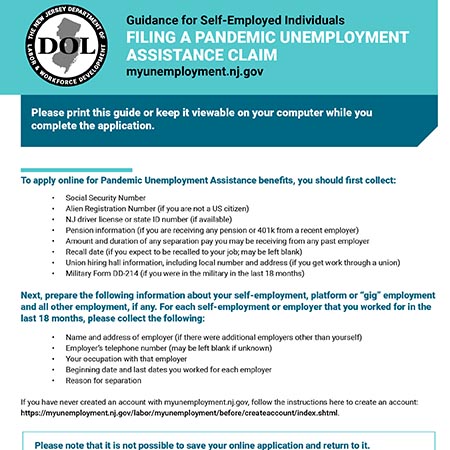

Division Of Unemployment Insurance Self Employed Nj Workers Unemployment Benefits During The Coronavirus Emergency Netherlands Womens Football Jersey

You may select or change your withholding status at any time by writing to the new jersey department of labor and workforce development unemployment insurance po box 908 trenton nj 08625 0908.

Netherlands womens football jersey. We will calculate your weekly benefit rate at 60 of the average weekly wage you earned during the base year up to that maximumwe determine the average weekly wage based on wage information your employers report. Click here for the request for change in withholding status form. For 2020 the maximum weekly benefit rate is 713.

As of 2010 in new jersey you will receive about 60 of your average weekly paycheck for the base year up to a maximum of 600. As of 2009 new. Your employers state unemployment tax rate depends on whether hes a new employer and his unemployment benefits history.

See the related link below for more information. New jersey does not tax unemployment benefits but the federal government does. President trumps executive memo spoke of restarting the extra unemployment payment at 400 but there have been some changes to how much recipients will receive and when.

So that means new jersey will have to pay 100 of the 400 in additional payments to the. Without the option to withhold taxes from the 600 payments workers could be are looking at a federal tax bill of.