1099 G New Jersey Unemployment

1099 G New Jersey Unemployment, Indeed recently has been hunted by consumers around us, perhaps one of you personally. People now are accustomed to using the internet in gadgets to view video and image information for inspiration, and according to the name of this article I will discuss about

If the posting of this site is beneficial to our suport by spreading article posts of this site to social media marketing accounts which you have such as for example Facebook, Instagram and others or can also bookmark this blog page.

If you received any of the following benefits in 2019 you need to log in to your account to download a 1099 g form for your 2019 tax return.

Design basketball jersey youth. The state of nj site may contain optional links information services andor content from other websites operated by third parties that are provided as a convenience such as google translate. Unemployment insurance benefits recipients will now have two options. We do not issue form 1099 g statements for unemployment insurance benefits.

Temporary disability during unemployment insurance benefits. It is possible to contact the irs for a wage transcript as well which can take time on the phone but they will not have the amount of state taxes that were withheld. They are issued by the division of unemployment insurance.

You dont need to include a copy of the form with your income tax return. However the form will no longer be automatically mailed. Division of unemployment insurance provides services and benefits to.

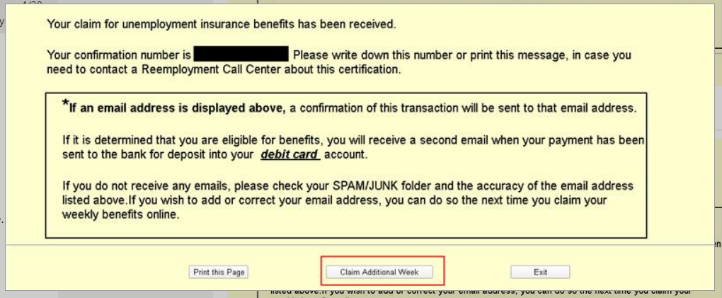

Once you have signed into the application click on viewprint 1099 g tax statement and then simply click continue after reviewing the instructions. You can also select or change your withholding status at any time by writing to the new jersey department of labor and workforce development unemployment insurance po box 908 trenton nj 08625 0908. These forms will not be accessible through the online service.

Po box 046 trenton new jersey 08646 0046 or send correspondence electronically through our nj onrs system and explain why you believe the form 1099 g andor 1099 int is incorrect. You can opt to have federal income tax withheld when when you first apply for benefits. Include the information necessary for us to provide a response name social security number tax year amounts contact information etc.

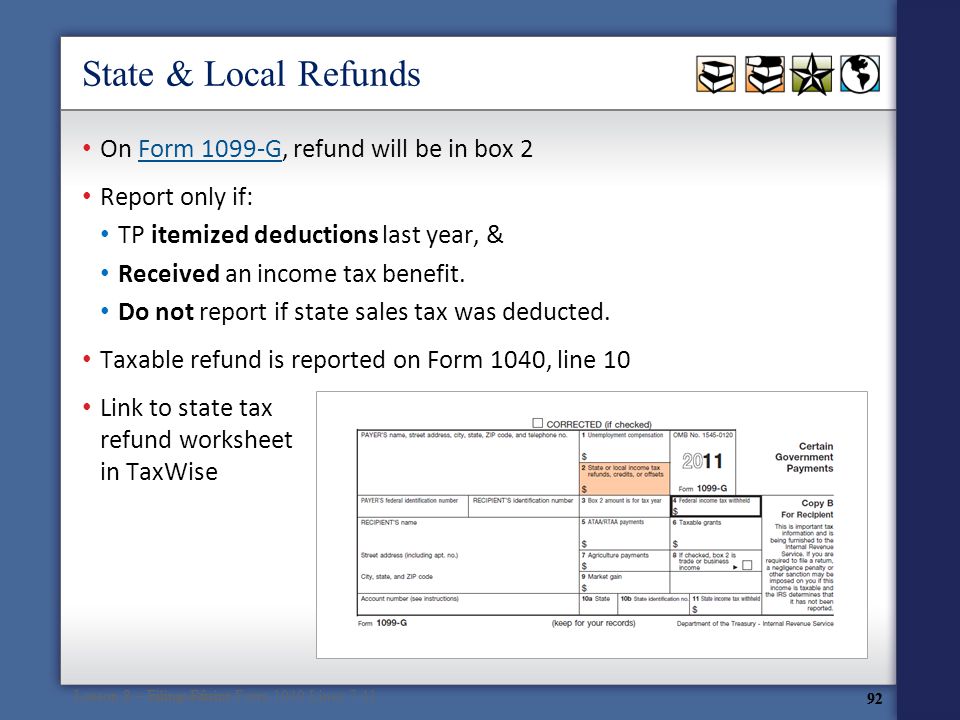

Family leave insurance benefits. Form 1099 g income tax statement showing the amount of unemployment insurance benefits paid and amount of federal income tax withheld will be available for download from your online dashboard in january following the calendar year in which you received benefits. Form 1099 g does not include interest paid by new jersey on an overpayment.

Enter the social security number that appears first on your new jersey gross income tax return the corresponding date of birth and the security code to begin the process. In this case your best option is to contact the nj state unemployment board to have them either send or re send the 1099 g form that reports unemployment insurance payments.

.jpg)