State Of New Jersey Withholding Tax Form

State Of New Jersey Withholding Tax Form, Indeed recently has been hunted by consumers around us, perhaps one of you personally. People now are accustomed to using the internet in gadgets to view video and image information for inspiration, and according to the name of this article I will discuss about

If the posting of this site is beneficial to our suport by spreading article posts of this site to social media marketing accounts which you have such as for example Facebook, Instagram and others or can also bookmark this blog page.

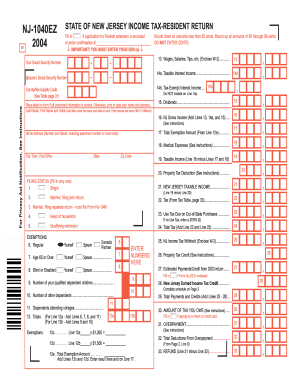

How to calculate withhold and pay new jersey income tax withholding rate tables instructions for the employers reports forms nj 927 and.

Basketball jersey design green color. If you have questions about eligibility filing status withholding rates etc. When completing this form call the division of taxations customer service center at 609 292 6400. Visit your states website to verify you are using the most up to date state w 4 form.

In cases like these an employee should use the wage chart on the form to. The more state tax withholding allowances an employee claims on their state w 4 the less you withhold. After collecting your employees completed state w 4 forms use them to determine how much to withhold.

New jersey cannot provide any information about the amount eligibility or when you may receive a payment. If you do not expect to owe income tax to new jersey at the end of the tax year do not request to have new jersey income tax withheld. If you choose not to withhold new jersey income tax you may be required to make estimated tax payments.

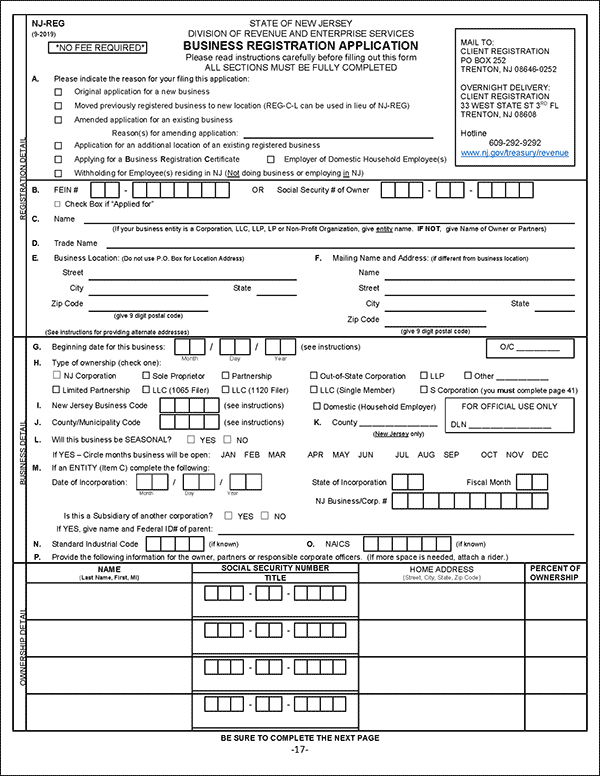

Please use the navigation to the left to complete your registration filing. You should use the online formations form instead if. Most states update their w 4 forms annually.

You want to start a new business in the state of nj llc pa dp non profit etc you need to authorize a legal entity in nj for your business in another state. If you use this option you can file forms nj927 nj w 3with w 2 and 1099 and wr30 pay withholding taxes and view information on past filings and payments. 187 19a which treats the presence of employees working from their homes in new jersey as.

Employees withholding allowance certificate. Please visit the irs website for more information. Nj 927 w instructions for domestic employers report form nj 927 h.

Telecommuter covid 19 employer and employee faq. When an employee has more than one job or if spousescivil union partners are both wage earners the combined incomes may be taxed at a higher rate. Tele commuting and corporate nexus as a result of covid 19 causing people to work from home as a matter of public health safety and welfare the division will temporarily waive the impact of the legal threshold within njsa.

Certificate of voluntary withholding of gross income tax from pension and annuity payments. New jersey gross income tax instruction booklet and samples for employers payors of pension and annuity income and payors of gambling winnings rev. No state or federal taxes will be taken out of your stimulus check and any stimulus money received does not affect your 2020 tax return.

New jersey employers must furnish form nj w4 to their employees and withhold new jersey income tax at the rate selected. New jersey income tax withholding. Use this form to have the payer of your pension or annuity withhold new jersey income tax for you.