State Of New Jersey Retirement

State Of New Jersey Retirement, Indeed recently has been hunted by consumers around us, perhaps one of you personally. People now are accustomed to using the internet in gadgets to view video and image information for inspiration, and according to the name of this article I will discuss about

If the posting of this site is beneficial to our suport by spreading article posts of this site to social media marketing accounts which you have such as for example Facebook, Instagram and others or can also bookmark this blog page.

State Of New Jersey Public Employees Retirement System Cash Disbursements Form Fill Out And Sign Printable Pdf Template Signnow Jersey Shirt In Navy

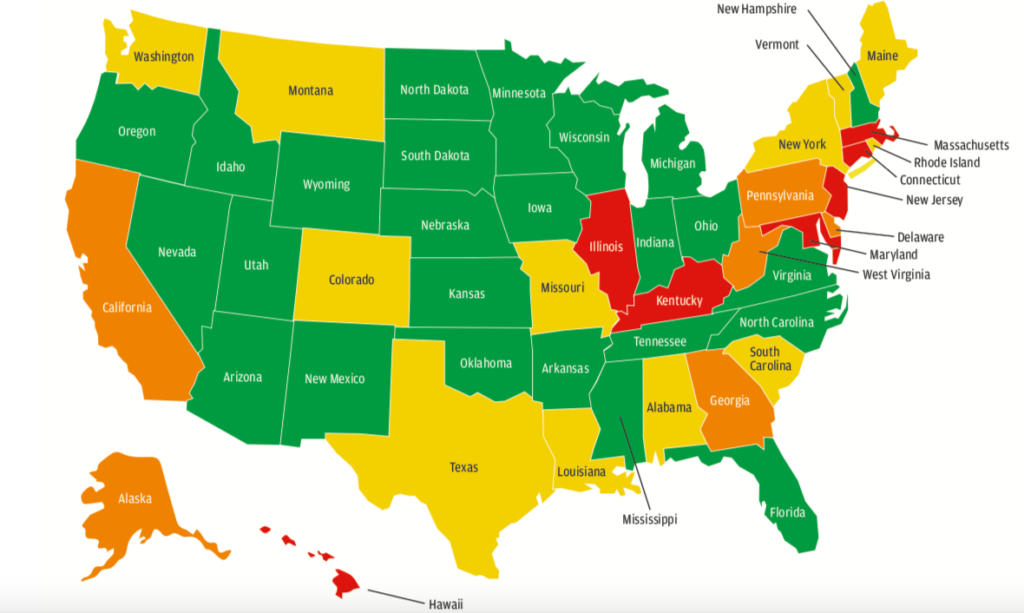

Overview of new jersey retirement tax friendliness.

Jersey shirt in navy. Although one of the smaller states new jersey boasts 44 beaches and nearly 130 miles of coastline. The state has beaches that range from tourist destinations amusement parks boardwalks and quiet beachside towns. Joining the state administered retirement systems.

Ive lived in new jersey for most of my life. Social security is not taxed at the state level in new jersey and state income taxes will be low for any retirees with income from retirement accounts and pensions below about 60000. Asbury park beach is consistently ranked as the number one beach in new jersey featuring one mile of white sand known for its boardwalks and songs from bruce springsteen.

Office of communications po. Many state agencies and organizations are responding with needed programs during this serious health emergency. 9120 the police and firemens retirement system of new jersey pfrsnj has extended the response due date for the request for qualifications for state and federal government affairs services to october 15 2020 and the proposal deadline to november 10 2020.

As i approach retirement my friends say it will be time to move to another state like florida the carolinas or delaware. Under the plan federal income tax is not due on deferred amounts or accumulated earnings until. New jersey state employees deferred compensation program njsedcp provides an opportunity to voluntarily shelter a portion of your wages from federal income taxes while saving for retirement to supplement your social security and pension benefits.

Box 295 trenton nj 08625 0295 the retirement system the state of new jersey established the pers in 1955 to replace the former state employees retirement system. In order for a new public employer to participate in the public retirement systems administered by the njdpb the employer must first be included in the state of new jerseys agreement with the social security administration. The njdpb is assigned all administrative functions of the retirement system except for invest ment.

Covid 19 services and assistance new jersey government is open and working for you. Please direct any questions to the pfrsnj using the contact information in the document. If you live in new jersey your retirement benefit is not subject to new jersey state income tax until you get back through pension checks the same amount you paid into the pension system while working.

The nj poison control center and 211 have partnered with the state to provide information to the public on covid 19.