State Of New Jersey Registration For Tax Employer Purposes

State Of New Jersey Registration For Tax Employer Purposes, Indeed recently has been hunted by consumers around us, perhaps one of you personally. People now are accustomed to using the internet in gadgets to view video and image information for inspiration, and according to the name of this article I will discuss about

If the posting of this site is beneficial to our suport by spreading article posts of this site to social media marketing accounts which you have such as for example Facebook, Instagram and others or can also bookmark this blog page.

The out of state seller must register for sales tax purposes and collect and remit sales tax on all sales delivered to new jersey.

Barcelona jersey sale. Make changes in legal structure or ownership type eg the business changes from a proprietorship to a partnership or llc. You want to start a new business in the state of nj llc pa dp non profit etc. When you have already formedauthorized your business in nj and need to register for tax purposes.

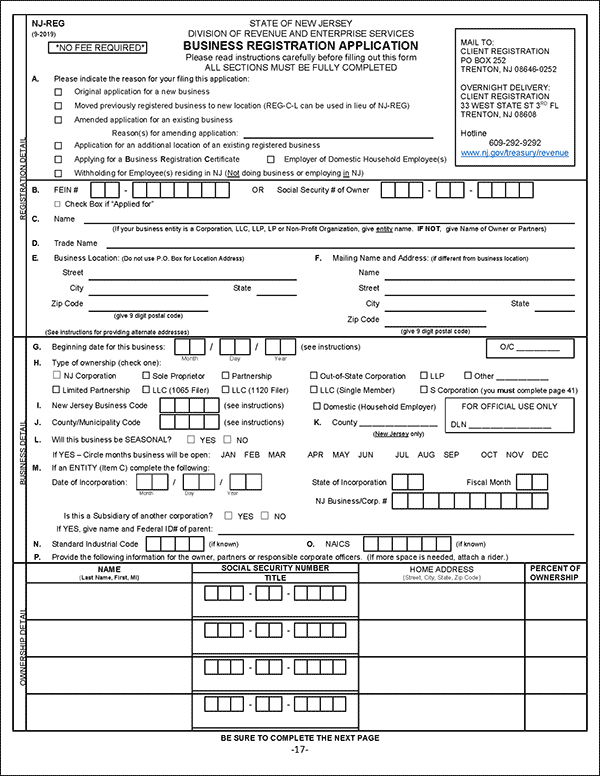

Register a new business for taxemployer purposes formregister the business per the process set forth on our home page. You should use the online formations form instead if. This number will serve as your business tax id in new jersey.

Because the law creates a rebuttable presumption the out of state seller may provide proof that the independent contractor or representative did not engage in any solicitation on their behalf in new jersey. For registry purposes the resulting entity is a new business. Filing form nj reg ensures that your business is registered under the correct tax identification number and that you will receive the proper returns and notices.

Please verify that your business is properly registered for tax and employer purposes with the division of revenue and enterprise services prior to proceeding with your filing. Please note that all corporations llcs and limited partnerships must register using their new jersey business entity id and ein. You must file form nj reg to be registered for tax and employer purposes step 2.

Every vendor whether a person or entity doing business in new jersey must register with new jersey at least 15 days before engaging in business activity. If you are registering a partnership or proprietorship you must provide either your ssn or ein. Pay your tax liability using an electronic check or credit card and receive immediate confirmation that your return has been received by the state of new jersey.

Online registration is available.