State Of New Jersey Refund

State Of New Jersey Refund, Indeed recently has been hunted by consumers around us, perhaps one of you personally. People now are accustomed to using the internet in gadgets to view video and image information for inspiration, and according to the name of this article I will discuss about

If the posting of this site is beneficial to our suport by spreading article posts of this site to social media marketing accounts which you have such as for example Facebook, Instagram and others or can also bookmark this blog page.

No state or federal taxes will be taken out of your stimulus check and any stimulus money received does not affect your 2020 tax return.

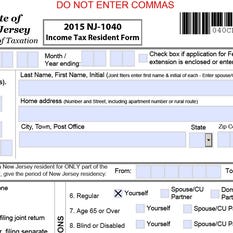

Basketball jersey design color yellow. If you did not receive your new jersey income tax refund check you can use this service to determine if the check was returned to the division by the us. Postal service and then submit an online claim to have the refund remailed to you. Nj residents need to file a form nj 1040x.

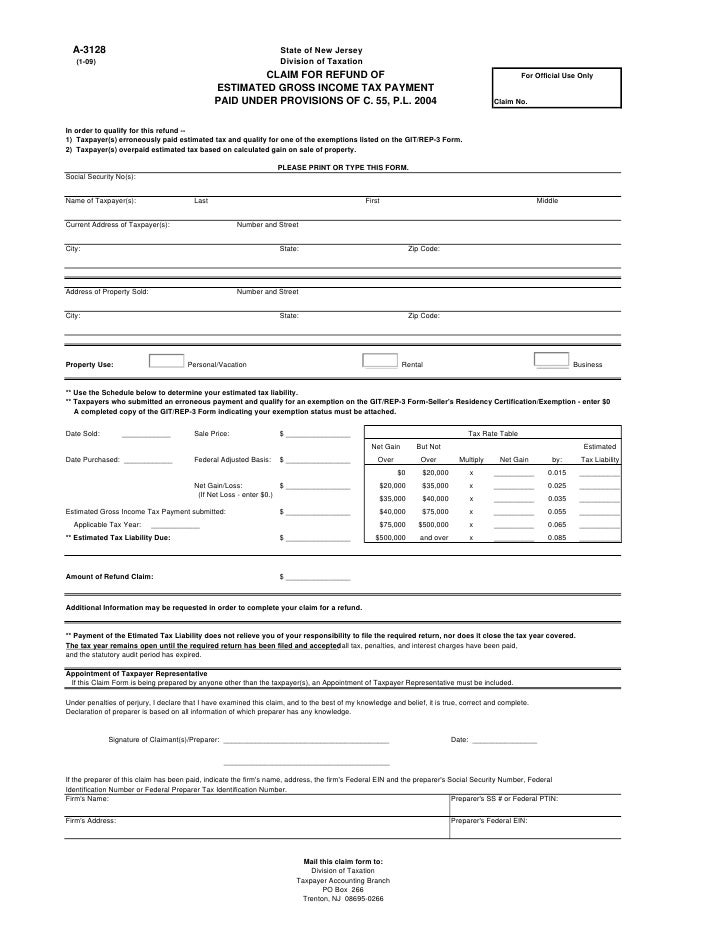

Beginning in january we process individual income tax returns daily. These anti fraud protections need to be revised every year because perpetrators are becoming more adept at refund fraud. Transferring information from returns to new jerseys automated processing system.

Amended new jersey state returns must be printed out and mailed to the new jersey division of taxation. Because traditional email is not secure we will not address specific tax account concerns through email. How new jersey processes income tax refunds.

New jersey department of revenue issues most refunds within 21 business days. By using your social security number and estimated refund amount you can check the status of your new jersey nj state tax refund. Since refund fraud resulting from identify theft has increased we are using additional tools to protect new jersey taxpayers.

Non residents should use a form nj 1040nr and write the word amended in the upper right hand corner. This means that we cannot give you any information about the status of your income tax refund homestead benefit senior freeze property tax reimbursement or. You can start checking on the status of your return within 24 hours after they have received your e filed return or 4 weeks after you mail a paper return.

Remember when you e file your tax return you generally receive your income tax refund faster than paper filing. New jersey cannot provide any information about the amount eligibility or when you may receive a payment. You may check the status of your refund on line at new jersey department of revenue.

Please visit the irs website for more information. If any part of the new jersey tax deducted on the federal return is later refunded that amount has to be reported as taxable income for the year in which the refund is issued. When calculating itemized deductions on your federal tax return you are allowed to deduct new jersey income taxes paid during the year.