My New Jersey Income Tax

My New Jersey Income Tax, Indeed recently has been hunted by consumers around us, perhaps one of you personally. People now are accustomed to using the internet in gadgets to view video and image information for inspiration, and according to the name of this article I will discuss about

If the posting of this site is beneficial to our suport by spreading article posts of this site to social media marketing accounts which you have such as for example Facebook, Instagram and others or can also bookmark this blog page.

If you rent an apartment or a house you can deduct 18 of your yearly rent to cover paid property taxes.

Sport jersey kajang selangor. Exact amount of your refund. Beginning in january we process individual income tax returns daily. For 2019 new jersey individual income tax rates and income thresholds for single filers and married or civil union filers filing separately are.

If you recently submitted a veteran income tax exemption submission form and supporting documents you will receive an email acknowledgement. New jersey has the highest property taxes in the country. 2018 or 2019 refunds only.

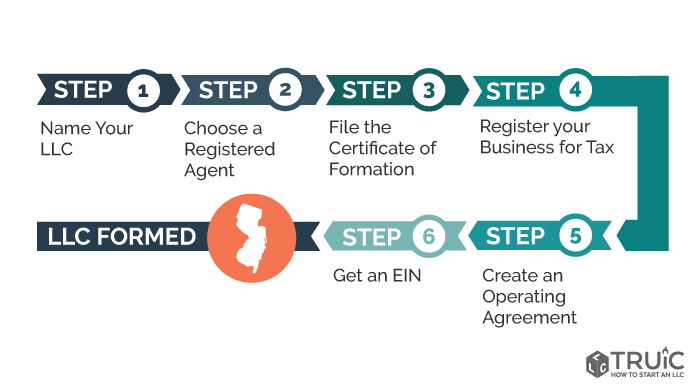

Ensuring that we transferred the information correctly. Both options are available 24 hours a day seven days a week. Nj income tax check on a refund.

For the 2019 tax year a married couple filing jointly could exclude 80000 of pension income from new jersey income taxes long as their total income does not exceed 100000. For 2020 the same. Check the status of your refund.

Checking for inconsistencies as well as math and other errors. To do so you must know the. You may use our online service to check the status of your new jersey income tax refund.

Property income arising in jersey. You should only use the online refund status service if you filed your return at least 4 weeks ago electronically or 12 weeks ago paper. New jersey state income tax beginning with tax year 2018 the top income tax bracket income over 5 million dollars will be taxed at an increased rate of 1075.

You earned income from a new jersey source and your total income for the year is greater than the earning threshold given above. 14 for taxable income of 20000 or less 175 for taxable income of 20001 35000. New jersey has a special tax program that allows all residents to deduct as much as 100 of their property tax burden from their taxable income.

The state has a progressive tax based on your filing status and income bracket. If you did not provide an email address we will mail you a letter. Abolition of articles 115g and 115ga tax deductibility of pension contributions by an employer self employed people and traders tax information.

The average effective property tax rate is 244 which means that on average homeowners in new jersey pay almost 250 of their home value in property taxes each year. How new jersey processes income tax refunds. In nearly half of new jerseys counties real estate taxes for the average homeowner are higher than 8000 annually.

Transferring information from returns to new jerseys automated processing system. If you own your residence 100 of your paid property tax may be deducted up to 10000.